Summary

- The surge in Kakao Pay's share price is largely attributed to heightened expectations for the adoption of a KRW stablecoin.

- Utilizing a KRW stablecoin for payments could benefit the payment platform market through lower fees and faster transactions.

- Speculation surrounding Kakao Pay's potential acquisition of SSG Pay, introduction of the Digital Asset Basic Act, and appointment of key policymakers have boosted investor sentiment.

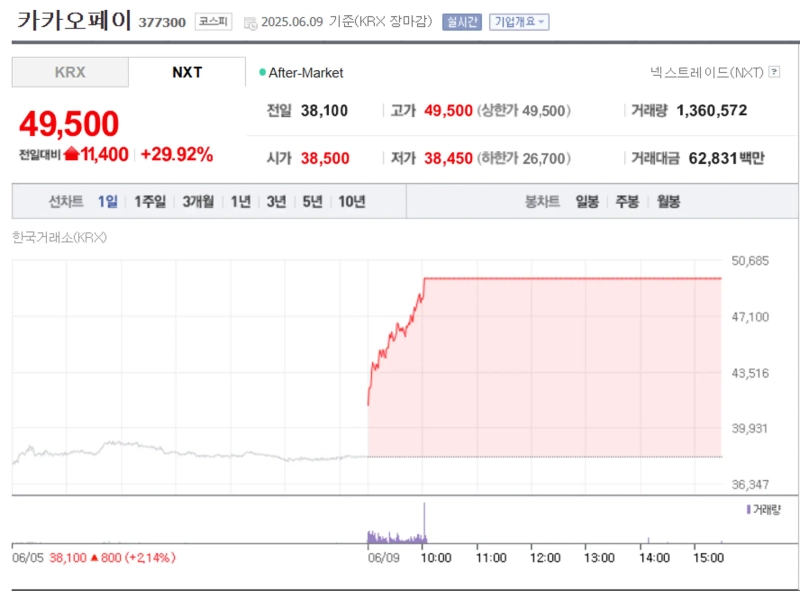

Amid growing anticipation for the introduction of a KRW-based stablecoin, Kakao Pay has hit the upper price limit.

On the 9th (local time) in the KOSPI Market, Kakao Pay closed at ₩49,500, up 29.92% from the previous session. That's an increase of nearly 70% since the 21st of last month.

This rally appears to be driven by expectations that discussions on launching a KRW stablecoin will finally move forward. If a KRW stablecoin is used for payments, overall payment platform market players are expected to benefit, thanks to lower fees and faster transactions. Recently, speculation that Kakao Pay will acquire Shinsegae Group's SSG Pay service has also boosted stock prices.

Talks over introducing a KRW stablecoin are rapidly gaining momentum. The Digital Asset Basic Act, which includes regulations on KRW stablecoin issuance, is scheduled to be tabled tomorrow (the 10th). On the 6th, Kim Yong-beom, a former First Vice Minister of Economy and Finance who has advocated the need for a KRW stablecoin as the first Chief Presidential Policy Officer, was appointed.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)