Editor's PiCK

Last week, $224 million flowed into virtual asset investment products…"Led by Ethereum"

Summary

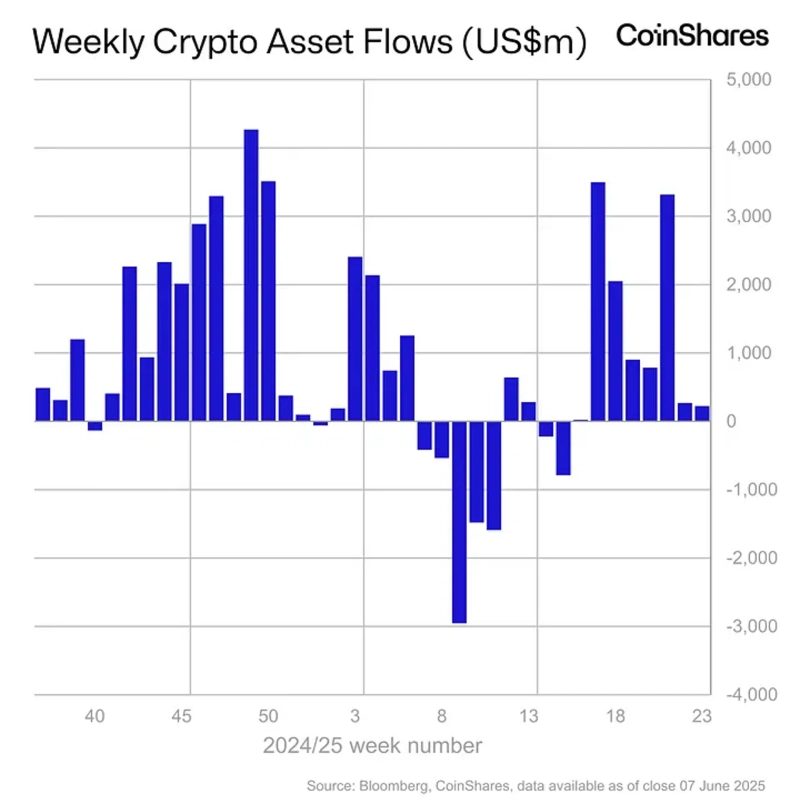

- CoinShares reported that last week, global virtual asset investment products saw a net inflow of $224 million, bringing the total inflow over seven consecutive weeks to $11 billion.

- Especially for Ethereum (ETH) products, $296.4 million flowed in, accounting for 10% of total assets under management and clearly indicating investor sentiment is recovering.

- On the other hand, funds flowed out of major Bitcoin (BTC) and key altcoin products, which the report attributed to investors' cautious sentiment amid policy uncertainty.

Last week, global virtual asset (cryptocurrency) investment products saw a net inflow of $224 million (₩303.1 billion).

On the 9th (local time), CoinShares reported, "Last week, virtual asset investment products recorded a net inflow of $224 million," adding, "This brings the cumulative inflows over seven consecutive weeks to $11 billion." However, they also noted, "Heightened policy uncertainty from the U.S. Federal Reserve (Fed) is slowing down the pace of inflows."

In particular, demand for Ethereum (ETH) was strong. Last week, global Ethereum products saw an inflow of $296.4 million, continuing a seven-week streak of inflows. The cumulative inflow over those seven weeks approaches $1.5 billion. The report evaluated, "This accounts for about 10% of the total assets under management (AUM) for all Ethereum products, marking the strongest trend since the U.S. presidential election last year," and added, "Investor sentiment toward Ethereum is showing clear signs of recovery."

In the case of Bitcoin (BTC), there was an outflow of $56.5 million, marking a second consecutive week of slight outflows. Short (sell) Bitcoin products also saw an outflow of $4.1 million. The report analyzed that investor wait-and-see sentiment due to policy uncertainty affected the outflows.

Altcoins also showed lackluster performance. Sui (SUI) saw a minor inflow of $1.1 million, while Solana (SOL) and XRP saw outflows of $2.1 million and $4 million, respectively.

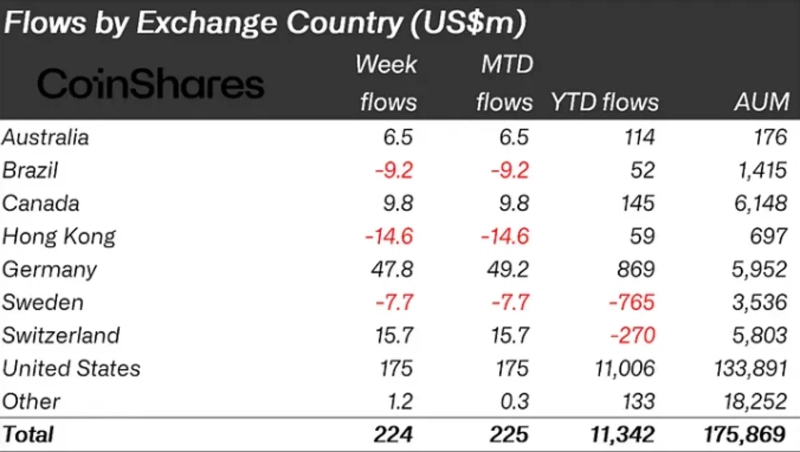

By country, inflows from the United States were strong. U.S.-based virtual asset products alone saw a net inflow of about $175 million, followed by Germany and Switzerland with inflows of $47.8 million and $15.7 million, respectively. Canada and Australia recorded inflows of $9.8 million and $6.5 million each. On the other hand, Brazil and Hong Kong saw outflows of $9.2 million and $14.6 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)