Summary

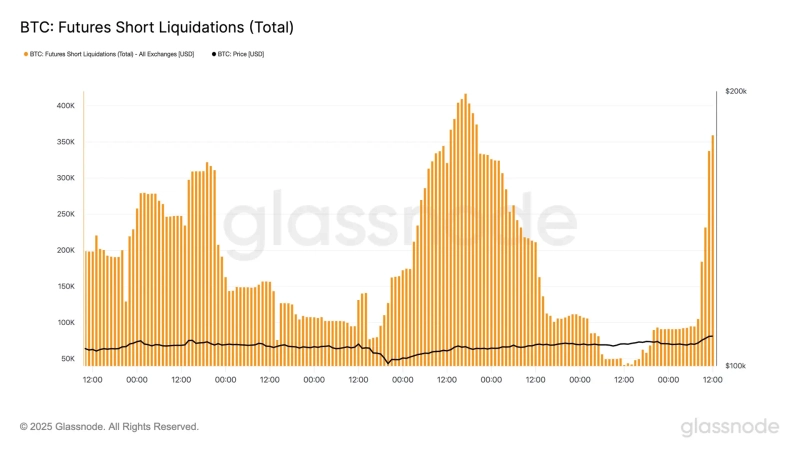

- Glassnode reported that Bitcoin's rise was attributed to the liquidation of large-scale short positions.

- Glassnode stated that a short squeeze occurred, resulting in the amount of short liquidations surging from $105,000 to $359,000 in just four hours.

- Currently, Bitcoin is trading at $107,280 on the Binance USDT Market, up 1.46% from 24 hours ago.

There are claims that the rise in Bitcoin (BTC) is attributable to the liquidation of large-scale short (sell) positions.

On the 9th (local time), Glassnode stated on X (formerly Twitter), "Today, Bitcoin surged from $105,000 to $107,000," adding, "This increase is due to the liquidation of large-scale short positions." They further explained, "Last week's negative funding rate indicated an increase in short positions in the market," and added, "With a short squeeze occurring, the amount of short liquidations surged from $105,000 to $359,000 in just four hours."

As of 11:10 p.m., Bitcoin is trading at $107,280 on the Binance USDT Market, up 1.46% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)