Editor's PiCK

Can KakaoPay issue stablecoins…"Possible depending on interpretation"

Summary

- It was stated that the issuance and distribution of stablecoins by fintech companies is currently difficult under the law, but could be permitted depending on regulatory interpretation.

- It was reported that financial authorities are expected to introduce separate licensing systems such as virtual asset payment business and wallet service business.

- The minimum equity capital requirement for issuing stablecoins has been adjusted to over ₩500 million, but this could be raised further by presidential decree.

Attention is being paid to whether fintech companies will be able to directly issue and distribute stablecoins. Although the current law prohibits 'self-issued coin trading,' there is a possibility of a flexible interpretation that could narrow the scope of regulatory application.

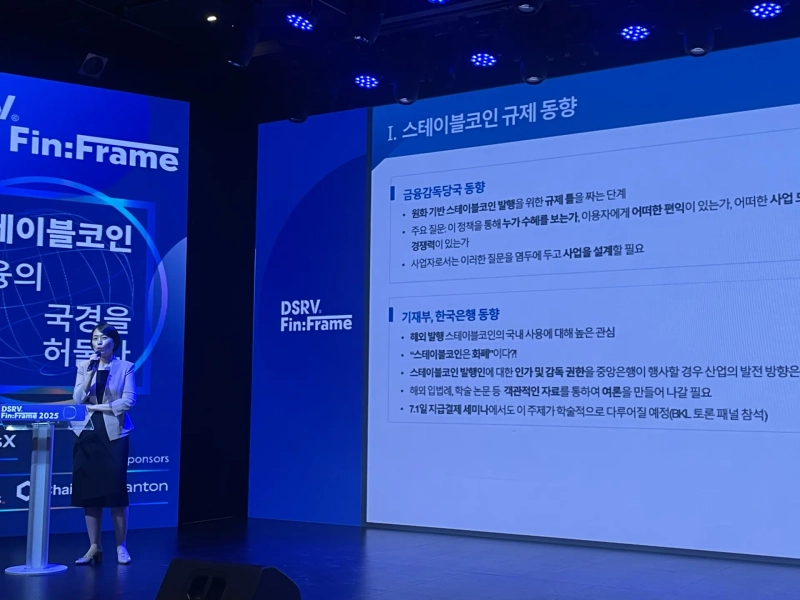

Kim Hyo-bong, an attorney at Bae, Kim & Lee LLC, stated at the 'Fin:Frame 2025' seminar held in Gangnam-gu, Seoul on the 10th, "It is currently difficult under the law for fintech companies to issue and distribute stablecoins themselves." However, he added, "There is room for financial authorities to approach related legislation more flexibly."

Attorney Kim explained, "The Virtual Asset User Protection Act contains a blanket prohibition stating that 'one cannot trade or transact virtual assets issued by oneself or a related party.' Interpreted as is, fintech companies cannot both issue and distribute coins." He added, "If the provision is applied only to trading inside virtual asset exchanges, it could lead to a different outcome. Fintech companies might be allowed to issue and distribute coins."

With the growing participation of fintech companies, a separate licensing system such as "virtual asset payment business" or "wallet service business" is also expected to be introduced. Kim said, "Currently, the Electronic Financial Transactions Act is not based on blockchain-based payments, so there is a high possibility a separate payment business license will be established via the Digital Asset Basic Act."

He went on, "If exchanges between fiat currency and coins occur in a wallet, it used to be considered trading business, but under new legislation, this could be classified as activity for payment purposes and included within the payment business license."

He also commented on the requirement for minimum capital presented as a condition for issuing stablecoins. On this day, Min Byung-deok, a lawmaker from the Democratic Party of Korea, proposed the Digital Asset Basic Act, which allows Korean corporations with more than ₩500 million in equity capital to issue stablecoins.

Attorney Kim said, "In the early version of the bill, the requirement was set at ₩5 billion, resulting in industry backlash, but it is now adjusted to more than ₩500 million." He added, "Looking closely at the bill, the amount of required capital will be determined by presidential decree. In the end, the requirement could be raised to over ₩500 million." He further argued, "In the future, it might also be required to accumulate additional capital in proportion to the issuance amount."

Regarding reserve assets for KRW stablecoins, he commented, "Korea doesn't have many government-issued short-term bonds, so it is necessary to diversify reserves to include deposits and highly liquid assets." He added, "Like the EU’s MiCA, it’s possible to consider holding some portion as bank deposits, and the rest as highly liquid, low-risk assets."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)