Arthur Hayes: "If the Bank of Japan Moves to Quantitative Easing, Risk Assets Will Soar"

Son Min

Summary

- BitMEX co-founder Arthur Hayes stated that if the Bank of Japan switches to quantitative easing, risk assets would soar.

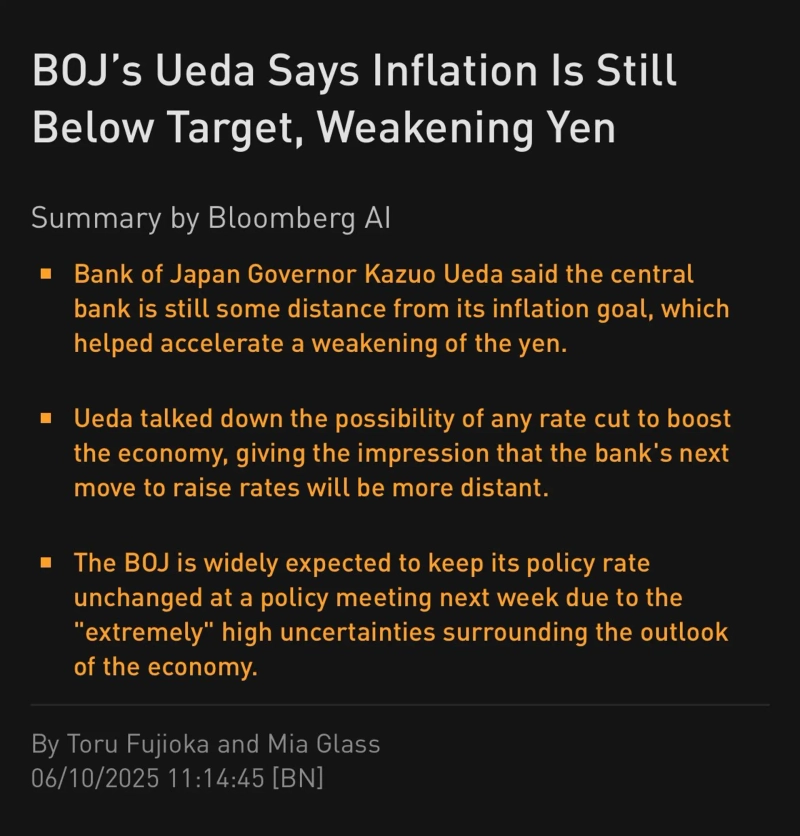

- Cointelegraph reported that an interim assessment of the quantitative tightening policy will be conducted at the Bank of Japan's monetary policy meeting.

- With suggestions of a possible change in the BOJ's policy direction, attention should be paid to the risk asset markets, including digital assets.

There is a claim that if the Bank of Japan (BOJ) shifts to quantitative easing (QE), risk assets could surge.

On the 10th (local time), Arthur Hayes, co-founder of BitMEX, stated on X (formerly Twitter), "If the Bank of Japan delays quantitative tightening (QT) and restarts quantitative easing, risk assets will skyrocket."

Cointelegraph, a media outlet specializing in digital assets (cryptocurrencies), also added that "the monetary policy meeting of the Bank of Japan on the 16th will conduct an interim assessment of the quantitative tightening policy" and "there is a possibility of a change in the BOJ's policy direction."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)