Editor's PiCK

US Bitcoin Spot ETF sees net inflow of $427.88 million...for two consecutive trading days

Summary

- The US Bitcoin spot ETF market has reportedly seen net capital inflow for two straight days.

- Notably, BlackRock’s 'IBIT', among others, posted a high net inflow, driven largely by institutional capital.

- Bitcoin price also remained strong, with the market’s attention focused on whether it will break the $111,980 high.

The United States Bitcoin spot ETF market has continued its upward momentum with capital inflows for two consecutive days.

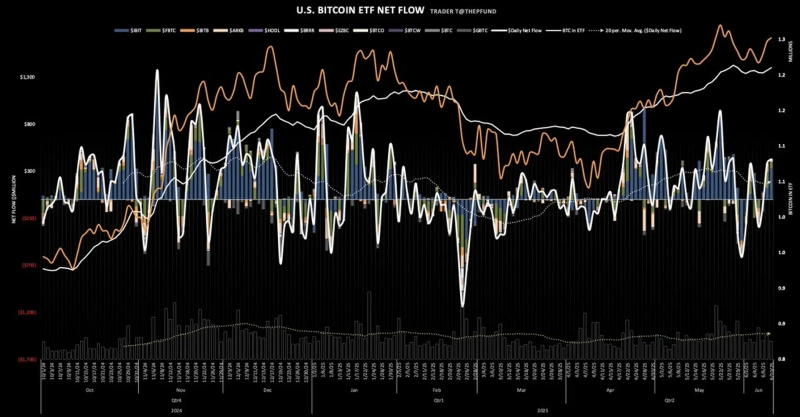

According to data from Trader T on the 10th (local time), the total net inflow into US-listed Bitcoin spot ETFs was $427.88 million. The VWAP (Volume Weighted Average Price) of Bitcoin was around $108,740.

The product with the largest capital inflow was BlackRock's 'IBIT', with a one-day net inflow of $333.51 million. Next, Fidelity’s 'FBTC' saw an inflow of $67.07 million, ARK Invest’s 'ARKB' had $20.25 million, and Invesco’s 'BTCO' saw $7.65 million flow in.

Bitwise’s BITB experienced an outflow of $600,000 on the day. Other ETFs had neither inflows nor outflows.

With this institutional capital inflow, Bitcoin’s price also remained strong. On the Binance Tether (USDT) market, Bitcoin briefly surpassed $110,000 during intraday trading, and is currently trading around $109,580. The market is focusing on whether the previous high of $111,980 can be broken.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)