Editor's PiCK

Ethereum surges past $2,800 after 4 months... ETF posts net inflows for 17 consecutive sessions

Summary

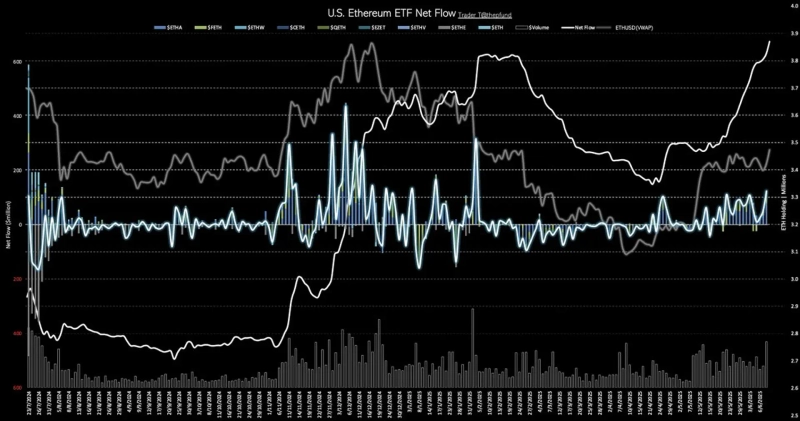

- The US spot Ethereum ETF market has posted net inflows for 17 consecutive trading days.

- Recently, the price of Ethereum surged by about 12%, surpassing the $2,800 mark for the first time in four months.

- Market analysts point to expectations for the stablecoin regulatory bill and DeFi deregulation as key reasons behind Ethereum’s rally.

The US spot Ethereum ETF market recorded net inflows for 17 consecutive trading days.

According to data from TraderT on the 10th (local time), the total net inflow for spot Ethereum ETFs that day was $124,010,000. This marks the highest trading volume in the past four months.

BlackRock's 'ETHA' attracted the most capital with $79,670,000. Fidelity's 'FETH' saw $26,320,000 in inflows, Bitwise's 'ETHW' brought in $8,350,000, and Grayscale's 'ETH' had $9,670,000. Other ETFs saw neither inflows nor outflows.

Recently, the price of Ethereum has been rapidly rising as well. Over the past two days, Ethereum surged approximately 12%, breaking above the $2,800 mark intraday for the first time in about four months. As of now, Ethereum is trading at around $2,790 on Binance Tether (USDT), up about 3% from the previous day.

Analysts note that expectations over the passage of the stablecoin regulatory bill, the GENIUS Act, and the SEC's indication of easing DeFi regulations are driving Ethereum’s uptrend. In particular, Ethereum is regarded as the primary network for more than half of all stablecoin issuance, suggesting it stands to benefit significantly from potential policy changes.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)