Editor's PiCK

Ripple CTO: "XRP Ledger, Specialized for Finance…A Public Blockchain Suitable for Institutions" [APEX 2025]

Summary

- Ripple CTO stated that the XRP Ledger is suitable for Web3 finance and optimized for institutions as a public blockchain.

- XRP Ledger is seeing growing institutional interest and adoption based on its strengths of speed, reliability, and low fees compared to conventional finance.

- Various financial products such as stablecoin-based payments, collateral liquidity, and digitization of trade are helping to solve traditional financial issues.

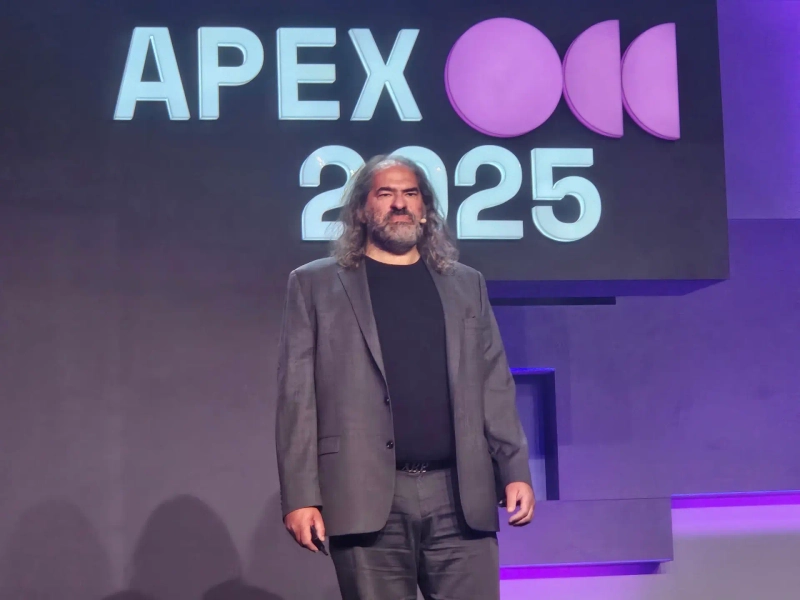

David Schwartz, CTO of Ripple, asserted that the XRP Ledger (XRPL) is a blockchain well-suited as a solution for Web3 finance.

On the 11th (local time), at Ripple's 'APEX 2025' event in Singapore, Schwartz emphasized, "The most frequently asked question in the industry is 'How is the XRP Ledger different from Bitcoin (BTC) and Ethereum (ETH)?' Bitcoin is designed as a store of value, Ethereum is application-centric, whereas the XRP Ledger is built as a platform for financial applications."

He further added, "Because of this focus, since its mainnet launched in 2012, we have concentrated on speed, reliability, and low fees."

Schwartz CTO explained that the recent acceleration of institutional entry into Web3 can also have a positive impact on the XRP Ledger. He stated, "In the past, institutions perceived using public blockchains as very risky, but now, a perception is spreading that not using public chains is even riskier." He emphasized, "Institutions are already launching many products on public blockchains, including the XRP Ledger."

Ripple also stated that the products on the XRP Ledger go beyond simple design and are being used in practice, which has attracted institutional interest.

Joining Schwartz on the session, Jazzy Cooper, Product Lead at RippleX, commented, "What attracts institutions most to the XRP Ledger is that stablecoin-based payments have moved beyond ideas to actual transactions." He added, "Compared to fees over 6% on a $200 remittance in traditional finance, stablecoin-based remittances significantly reduce fees."

Additionally, Cooper cited the strengths of the XRP Ledger as: ▲increased collateral liquidity through tokenization, ▲the digitization of trade via smart escrow, among others. He stated, "The XRP Ledger is infrastructure that is operational right now," noting "The XRP Ledger is already solving infrastructure issues that existed in traditional finance."

Singapore—Jinwook Bloomingbit

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)