Editor's PiCK

"3,000 is in sight"...KOSPI breaks through the 2,900 mark just five trading days after new government launches

Summary

- The KOSPI index broke through the 2,900 mark for the first time in 3 years and 5 months, driven by strong net purchases from foreign investors.

- Since the launch of the Lee Jae-myung administration, KOSPI has steadily risen, with securities firms revising up their KOSPI forecasts and picking finance, nuclear power, defense, and holding companies as top sectors.

- The market believes that the new government's corporate governance reform policies and improving U.S.-China relations are boosting investor sentiment.

Breaks through the 2,900 mark during the session for the first time in 3 years and 5 months

Honeymoon rally...Foreign investors 'buying spree'

The KOSPI index broke through the 2,900 mark during the session for the first time in about 3 years and 5 months. Since the inauguration of the Lee Jae-myung administration, the 'honeymoon rally' has continued for five consecutive trading days. In the securities industry, some have set an upper forecast for KOSPI at 3,240.

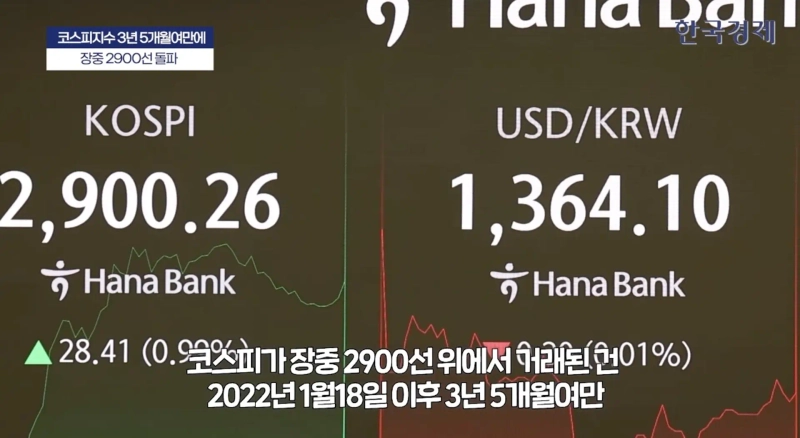

As of 9:36 a.m. on the 11th, KOSPI stands at 2,901.77, up 29.92 points (1.04%) from the previous day. At 9:28 a.m. this day, it hit 2,900.69, breaking through the 2,900 mark. This is the first time KOSPI has traded above 2,900 during the session since January 18, 2022, over 3 years and 5 months ago.

The inauguration of the Lee Jae-myung administration has triggered a 'honeymoon rally.' From the 4th, when the new government launched, up to the previous day, KOSPI rose 6.41% over four trading days. During this period, foreign investors made net purchases of ₩3,652.4 billion in shares on the main board.

Today as well, foreign investors continue to boost the index by buying ₩65.8 billion in spot stocks and ₩237.1 billion in KOSPI 200 futures on the main board. Individuals, who made strong net purchases immediately after the opening, have turned to net selling, offloading ₩53.6 billion. Institutions are also net sellers of ₩500 million.

Among large-cap stocks by market capitalization, performances are mixed. Samsung Electronics and SK hynix are up 1.18% and 3.9%, respectively. Samsung Electronics is again attempting to break back above the ₩60,000 mark. This follows the Philadelphia Semiconductor Index rising more than 2% on the New York Stock Exchange overnight. Expectations surrounding ongoing U.S.-China trade negotiations in London have boosted investor sentiment in the semiconductor sector. There is speculation that restrictions on semiconductor sales to China may be eased.

LG Energy Solution (1.39%), Hyundai Motor (1.78%), Kia (1.9%), etc. are also strong amid easing tariff war expectations.

Investor sentiment for Korean stocks seems to have improved as President Lee Jae-myung, who pledged to 'break through the KOSPI 5,000 mark during his term,' is now leading the government. He is scheduled to visit the Korea Exchange today to deliver remarks on issues related to the stock market.

The Democratic Party, which has become the ruling party under the new government, plans to actively promote policies that encourage governance improvements (corporate governance reform) to expand the rights of all shareholders, not just controlling shareholders. In his inaugural address, President Lee declared, "Gaining profit by breaking rules, while those who stick to the rules suffer, as with unfair trading such as stock manipulation, will never be tolerated as it threatens market order."

As a result, securities firms are raising KOSPI forecasts one after another. KB Securities set an upper forecast for KOSPI at 3,240 today. Researcher Lee Eun-taek of KB Securities picked finance, nuclear power, defense, and holding companies among the top preferred sectors. Regarding finance, Lee said, "(The new government's) capital market structural reforms are expected to bring positive changes across the financial sector," adding, "especially, policies improving corporate governance will raise expectations for a re-rating of the Korean stock market." Previously, Wall Street also issued a 'KOSPI 3,000' outlook. Goldman Sachs upgraded its investment view on the Korean stock market to 'overweight' on the 7th, raising its 12-month KOSPI target index from 2,900 to 3,100.

KOSDAQ is trading at 779.28, up 8.08 points (1.05%) from the previous day. In this market, individuals and foreign investors are net buyers of ₩27.4 billion and ₩3 billion in shares, respectively, while institutions have sold ₩26.9 billion.

Most KOSDAQ large-cap stocks are rising. Only HLB remains flat. Alteogen is up 2.04%, Pharmaresearch 1.92%, Peptron 3.32%, and Hugel 1.1%. The 2nd battery sector, which was particularly strong early in the session, is seeing modest gains; Ecopro BM is up 2.6%, and Ecopro is up 0.23%.

In the Seoul foreign exchange market, the won-dollar exchange rate is trading at 1,362.2 won per dollar, up 4.8 won (0.35%) from the previous day.

Han Kyung-woo, Hankyung.com reporter case@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.