Editor's PiCK

[Today's Global Trending Coins] Ethereum·Hyperliquid·Solana etc.

Summary

- Ethereum recently broke through $2,800 for the first time in about four months, with high expectations of benefits from policy changes.

- Hyperliquid, with its high-leverage trades, posted record trading volumes and saw its platform token HYPE rise by 7%.

- Solana is in an uptrend due to expectations of spot ETF approval, with reports that the SEC is showing strong intentions for a swift approval.

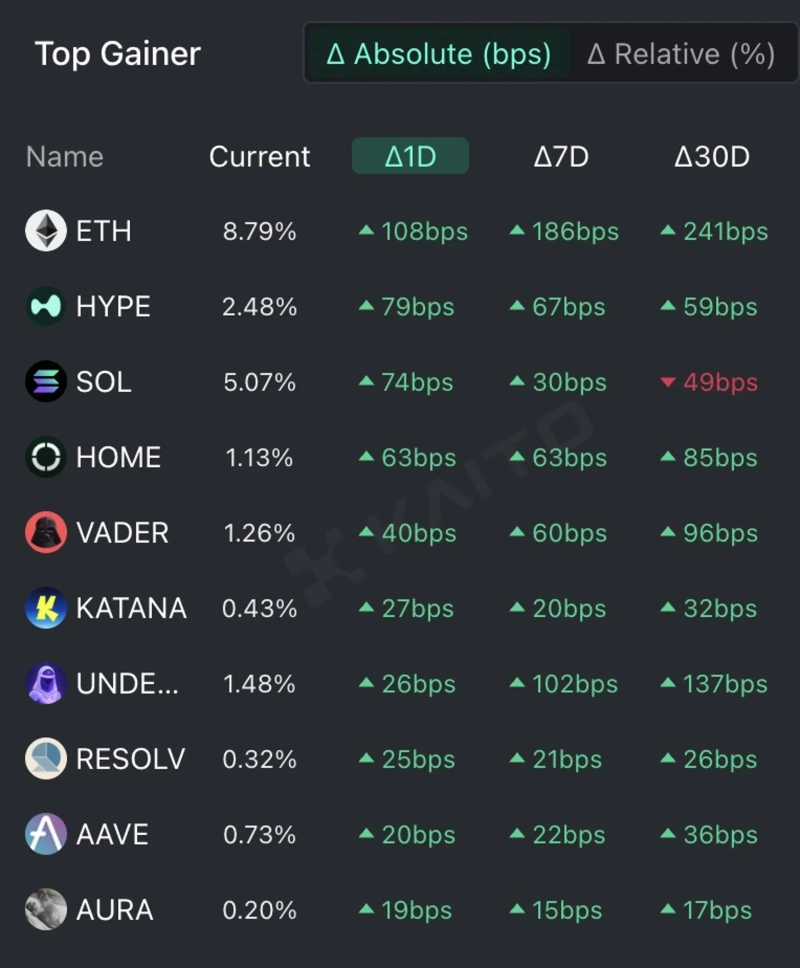

According to the top gainers on the AI-based Web3 search platform Kaito (Token Mindshare: an indicator that quantifies the influence of specific tokens in the virtual asset market), the top 5 virtual asset-related keywords that people are most interested in as of the 11th are Ethereum (ETH), Hyperliquid (HYPE), Solana (SOL), DeFi app (HOME), and VaderAI by Virtual (VADER).

Ethereum has surpassed $2,800 in about four months, drawing focused attention from investors. The main factors cited are expectations for the passage of the U.S. stablecoin regulation bill, the GENIUS Act, and the SEC’s stance on relaxing decentralized finance (DeFi) regulations.

Ethereum is the base chain where more than half of all stablecoins are issued, leading to expectations that it could greatly benefit from policy shifts. On this day, Ethereum was trading around $2,790 on the Binance Tether (USDT) market, up about 4% from the previous day.

As both Bitcoin and Ethereum rise, funds are continuing to flow into Hyperliquid, a decentralized derivatives exchange that allows high-leverage trading. An anonymous whale investor reportedly took a 20x leveraged Bitcoin long (buy) position on Hyperliquid that day.

Hyperliquid recorded a trading volume of $248 billion in May—a new all-time high on a monthly basis. The platform token 'HYPE' is currently trading at around $41, up about 7% in the last 24 hours.

Solana is showing an upward trend, backed by expectations for approval of a spot Exchange-Traded Fund (ETF). According to Blockworks, the SEC could approve a Solana spot ETF in as little as 3 to 5 weeks. Recently, the SEC reportedly requested issuers to submit revised S-1 registrations by next week.

Industry sources interpret this as the SEC showing a willingness to approve quickly through communication with issuers. On this day, Solana was trading at $164 on the Binance Tether market, up about 4.2% from the previous day.

In addition, investors have also been showing interest in coins such as Katana (KATANA), Aave (AAVE), and Aura (AURA).

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)