Editor's PiCK

Virtual Asset 24-Hour Futures Liquidations Hit $252.05 Million

Summary

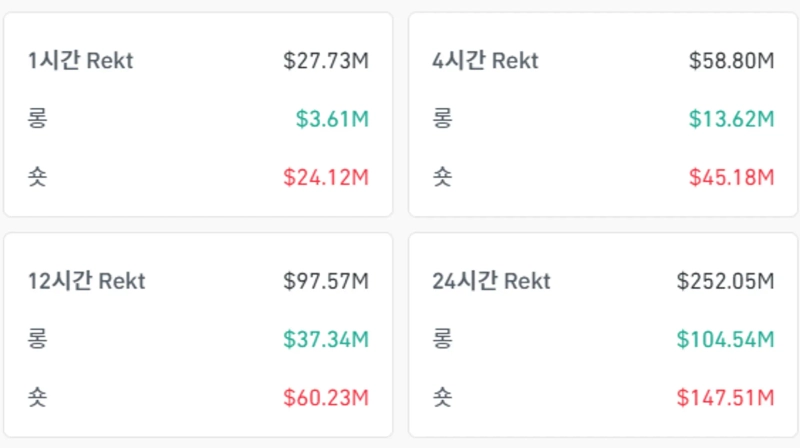

- It was reported that $252.05 million worth of positions were liquidated in the perpetual virtual asset futures market during the past 24 hours.

- It was noted that the majority of the liquidations were short positions due to the rise in Bitcoin, with Ethereum posting the largest amount of liquidations.

- Bitcoin and Ethereum are trading at $109,811 and $2,834, respectively, up 1.06% and 3.57% from 24 hours ago.

In the past 24 hours, perpetual futures positions in the virtual asset (cryptocurrency) market saw total liquidations amounting to $252.05 million.

According to CoinGlass data on the 11th (local time), a total of $252.05 million in futures positions were liquidated in the virtual asset market over the last 24 hours. Due to news of a US-China trade agreement and a lower-than-expected Consumer Price Index (CPI), Bitcoin (BTC) surged, resulting in the majority of liquidations being short (sell) positions. Specifically, $104.54 million in long (buy) positions and $147.51 million in short positions were liquidated.

The asset with the largest liquidation was Ethereum (ETH). Ethereum saw $95.54 million in position liquidations over 24 hours, with $37.09 million in long positions and $58.46 million in short positions liquidated, respectively. Bitcoin ranked second in the same period, with $39.83 million in liquidations. The amounts for long and short liquidations were $11.84 million and $27.98 million, respectively.

As of 11:50 PM, on Binance's USDT market, Bitcoin and Ethereum are trading at $109,811 and $2,834, up 1.06% and 3.57% compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)