Editor's PiCK

Perpetual Futures Liquidations Near $256.57 Million in 24 Hours… Impact of Poly Hedera Network Plunge

Summary

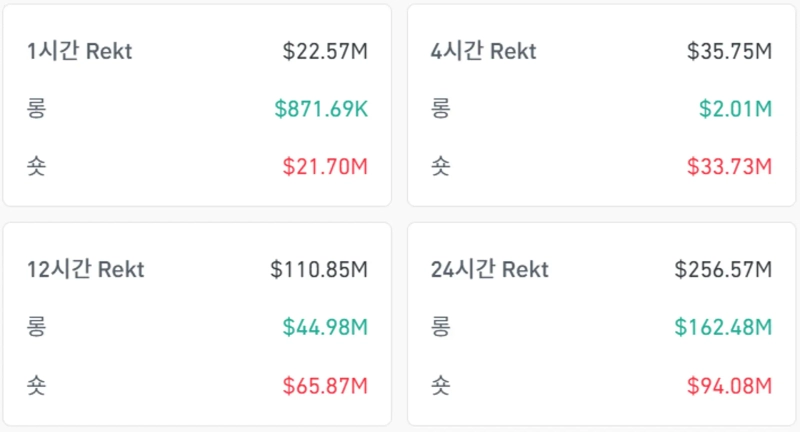

- A total of $256.57 million in perpetual futures market position liquidations occurred in crypto markets over the past 24 hours.

- The main reason for these liquidations was the sharp 83.78% decline in Poly Hedera Network (ZKJ), leading to $102.33 million in liquidations.

- Ethereum (ETH) and Bitcoin (BTC) also saw significant investor losses, recording liquidation amounts of $47.21 million and $30.5 million, respectively.

In the past 24 hours, the size of position liquidations in the virtual asset (cryptocurrency) perpetual futures market recorded $256.57 million.

According to CoinGlass data on the 16th (local time), the total amount of futures position liquidations in the crypto market over the last 24 hours reached $256.57 million. Specifically, long position liquidations amounted to $162.48 million, while short position liquidations totaled $94.08 million. The surge in long position liquidations is attributed to the sharp decline in Poly Hedera Network (ZKJ).

Previously, Poly Hedera Network, listed as a Binance Alpha project, drew significant investor attention as the most favorable asset for acquiring Alpha points. However, after Tether liquidity for 48 Club Token (KOGE) was depleted, traders began swapping 48 Club Token to Poly Hedera Network, which triggered a steep drop. Additionally, 15.5 million Poly Hedera Network tokens were unlocked during this process, contributing to further declines. As of 3:26 p.m., according to CoinMarketCap, Poly Hedera Network was trading at $0.3254, down 83.78% from the previous session.

As a result, Poly Hedera Network (ZKJ) also ranked as the asset with the largest liquidation size. Over 24 hours, Poly Hedera Network saw $102.33 million in position liquidations, with $97.73 million in long positions and $4.6 million in short positions liquidated. Ethereum (ETH) ranked second for the same period, with $47.21 million liquidated, including $19.08 million in long positions and $28.13 million in short positions.

Bitcoin (BTC) ranked third with $30.5 million in liquidations. The long and short position liquidation sizes were $11.16 million and $19.34 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)