Summary

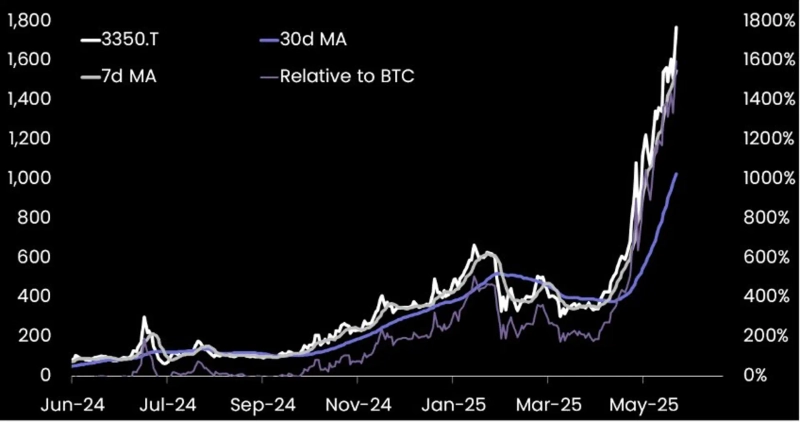

- MetaPlanet's surge is attributed to demand for indirect Bitcoin investment driven by Japan's virtual asset taxation policy.

- The report stated that the intrinsic value of Bitcoin held by MetaPlanet is $759,000 per share compared to its stock price, more than seven times the current Bitcoin price.

- MetaPlanet announced today that it additionally purchased 1,112 BTC, reaching a total BTC holding of 10,000.

The rise of MetaPlanet, a Bitcoin (BTC) reserve company listed on the Japanese stock market, is attributed to the government’s virtual asset (cryptocurrency) taxation policy, according to analysis.

On the 16th (local time), Matrixport stated in a report, "MetaPlanet is an asset that provides indirect Bitcoin exposure to Japanese investors facing constraints," adding, "This is because Japan imposes a tax of up to 55% on virtual asset gains." According to Investing.com, MetaPlanet surged 25% today.

The report further explained, "The Japanese government considers Bitcoin a strategic reserve asset, not a speculative asset," and, "Recent tax reforms have lowered barriers for companies to hold Bitcoin."

However, it was pointed out that the intrinsic value of the Bitcoin held by MetaPlanet is high. The report stated, "The intrinsic value per Bitcoin held by MetaPlanet amounts to $759,000 per share compared to its stock price," and, "This is over seven times the current Bitcoin price." It also evaluated, "This is the result of speculative demand, a limited number of tradable shares, and expectations for future Bitcoin price increases, showing similarities to early-stage strategy stocks."

Meanwhile, MetaPlanet additionally purchased 1112 BTC today, bringing its total BTC holdings to 10,000.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)