Ondo Finance: "Tokenization is already happening... We will tokenize stocks and ETFs as well" [Cointerview]

Summary

- Ian De Bode, CSO of Ondo Finance, said that the tokenization market is growing faster than expected and that more than $1 trillion in financial products will be tokenized within three years.

- Ondo Finance has tokenized traditional financial assets such as U.S. government bonds, and stated that it aims to diversify its tokenized products—including U.S. stocks and ETFs—in the future.

- To protect investors, Ondo Finance has adopted systems such as bankruptcy remoteness, seniority privileges, and insurance. It also announced plans to play a key role in global on-chain finance through its own Ondo chain.

Interview with Ian De Bode, Chief Strategy Officer of Ondo Finance

Overcoming the Limits of Traditional Finance Through Tokenization

"Diversifying Tokenized Products Including Stocks and ETFs"

"Tokenization is not the future, but already a reality. The tokenization market is growing much faster than we anticipated, and within the next three years, financial products worth more than $1 trillion will be tokenized."

Ian De Bode (photo), CSO of Ondo Finance (Ondo Finance, ONDO), shared this perspective in an interview with Bloomingbit on the 19th.

Ondo Finance is a blockchain-based real world asset (RWA) project that tokenizes traditional financial assets. Its flagship products include the tokenized U.S. government bond "Ondo Short-Term US Government Bond (OUSG)" and the stablecoin backed by U.S. Treasuries "Ondo USD Yield Token (USDY)".

Ian, the CSO, is an expert in digital assets and tokenization who worked for approximately nine years as a digital asset consultant for corporations at one of the world's top three strategic consulting firms, McKinsey & Company. Through him, we learned more about the value of tokenization and Ondo Finance’s mission.

"Tokenization increases access to traditional financial products... 24/7 easy investing"

Ian explained, "In traditional finance, it is often difficult for investors to access the products they want. In particular, investing in U.S. stocks or government bonds is not easy," noting that, "Certain asset thresholds are often required, or there are complicated procedures and fees involved."

He believes these issues can be alleviated through tokenization. Ian stated, "In contrast to traditional finance, in an on-chain market where assets are tokenized, it's possible to invest in and transfer assets easily, 24 hours a day, 365 days a year," emphasizing that, "This greatly lowers the barrier to entry for financial products and provides fairness in access to assets."

He cited stablecoins as a representative example. Ian said, "Many people may think of stablecoins as ordinary virtual assets, but in reality, stablecoins are tokenized fiat currencies," adding, "Through this, many investors have gained easy access to popular fiat currencies such as the dollar." He continued, "The current total market capitalization of stablecoins is approaching $260 billion," noting, "This shows the market fit for stablecoins."

Aiming to tokenize U.S. stocks and ETFs... Preparing to launch 'Ondo chain'

Ondo Finance’s short-term goal is to tokenize U.S. stocks, exchange-traded funds (ETFs), and mutual funds. Since these assets already have mature markets and high liquidity, there is expected to be strong demand.

They have also left open the possibility of tokenizing assets such as real estate, private equity funds, and artworks. Ian commented, "Liquidity is very important in tokenization. While these products have lower liquidity compared to other financial assets, they can become attractive tokenized assets if real-time price discovery becomes possible."

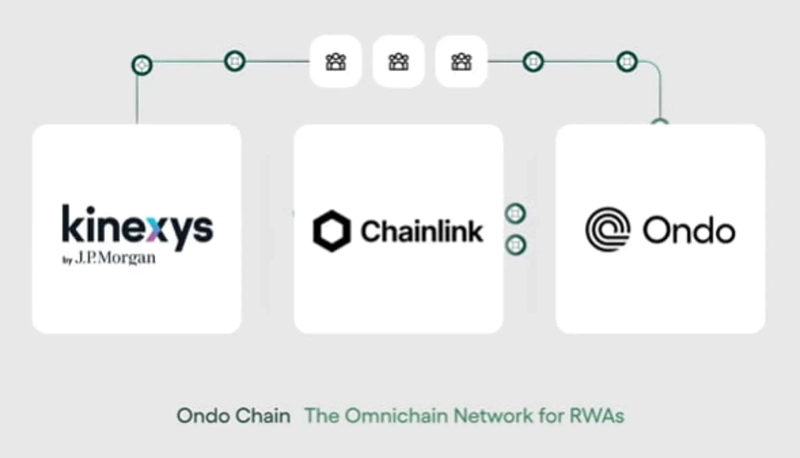

As for the long-term goal, he stated that it is to serve as a bridge between on-chain and traditional finance. To this end, Ondo Finance is currently preparing to launch its own Layer 1 project, "Ondo chain." Ondo chain is a dedicated infrastructure designed to provide all traditional financial services in a blockchain environment—including real-time collateral transfers, liquidity management, and asset transfers between institutions. The project is currently operating a testnet and conducting on-chain financial experiments such as tokenized bond settlements in collaboration with JPMorgan’s blockchain division, Onyx by JPMorgan, and Chainlink (LINK), the world’s largest investment bank.

Ondo Finance also said that, as a tokenization platform, it strives to protect investors. Ian explained, "On-chain finance investors should feel the same level of reassurance as when using traditional finance," adding, "We protect investors through bankruptcy remote structures, seniority privileges, and insurance."

He further stated, "Ondo Finance will not simply stop at putting assets on-chain," adding, "Through Ondo chain, we aim to play a central role in global on-chain finance."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)