Editor's PiCK

With rising tension from the Middle East and continued hawkish Federal Reserve stance... Is Bitcoin stuck in a trading range? [Trade Now by Minseung Kang]

Summary

- Aayush Jindal, a researcher at NewsBTC, diagnosed that Bitcoin is trading within a range between $103,500 and $105,500.

- If Bitcoin breaks through the $105,500 and $105,800 resistance levels, further rebounds above $110,000 are possible.

- On the other hand, if the support level collapses, there is the potential for a decline to the psychological support of $100,000 and even $93,000.

Former U.S. President Donald Trump’s hardline statement against Iran combined with policy uncertainty from the United States’ monetary authorities has left Bitcoin (BTC) unable to establish a direction around $104,000. As military clashes erupt between Israel and Iran, geopolitical tension is rising, prompting investors to adopt short-term defensive strategies.

Market experts note that if Bitcoin stably breaks through $105,800, an upward trend could continue; however, if it falls below $103,500, downside pressure could intensify.

At 11:23 a.m. on the 21st, according to Upbit’s KRW market, Bitcoin was trading at ₩144,150,000 (on Binance USDT market, at $103,408), up 0.13% from the previous day. At the same time, the kimchi premium (the price gap of virtual assets between foreign and domestic exchanges) rose slightly to 1.47%.

Trump’s ‘Iran Pressure’ & Hawkish Fed... Weakened Investor Sentiment

On the 19th (local time), Donald Trump, former U.S. President, stated, “There is a possibility for negotiations with Iran. Considering diplomatic solutions, I plan to decide within two weeks whether to take military action.” On the 18th (local time), Trump directly targeted Iran’s Supreme Leader, Ayatollah Ali Khamenei, warning, “I know exactly where he is. Surrender unconditionally,” but changed his tone within half a day. Later that afternoon, Trump said, “I may or may not attack Iran. Since the circumstances of war keep changing, I’d like to delay the decision as long as possible,” expressing an ambiguous stance.

The Middle East situation remains turbulent. Khamenei, Iran’s Supreme Leader, responded to Trump’s demand for ‘unconditional surrender’ stating, “There will be no surrender. We will resolutely resist a forced war,” and warned that U.S. military involvement “will cause irreparable damage.” On this day, according to Reuters, the U.S. deployed additional fighter jets such as the F-35 to the Middle East.

Some speculate there is even a possibility of the U.S. dropping 'bunker busters' to target the core of Iran’s nuclear program, further suggesting that geopolitical risk may not be resolved quickly.

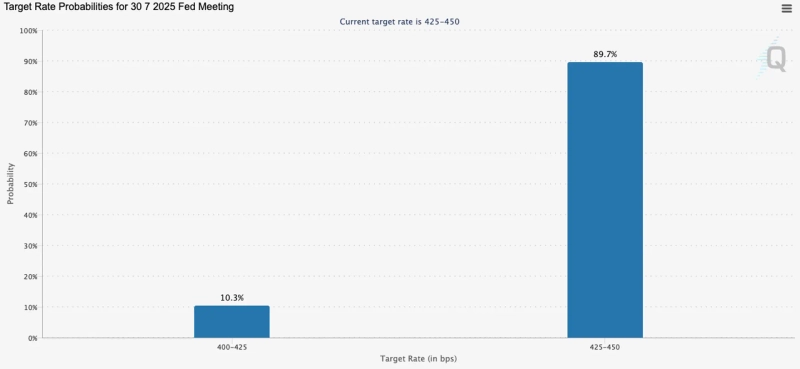

Meanwhile, the U.S. central bank, the Federal Reserve (Fed), on the same day (the 18th) kept the federal funds rate unchanged at 4.25–4.50%, reaffirming a wait-and-see stance. Jerome Powell, Fed Chair, said, “It will take time for (Trump’s) tariffs to affect consumer prices,” and, “Some shocks have just begun, and could intensify over the coming months.”

Market participants evaluated this rate hold as a ‘hawkish hold,’ favoring monetary tightening. This is because the FOMC dot plot, which reflects future interest rate outlooks, was more hawkish than expected. While two rate cuts are still projected for this year, the number of expected cuts next year and the year after was each reduced to one. The number of officials supporting a rate hold this year rose from four in March to seven now. Next year’s final rate is projected at 3.6%, and for 2027, at 3.4%.

In addition, the Summary of Economic Projections (SEP) released by the Fed revealed stagflation concerns. The 2024 forecast for U.S. real GDP growth was revised down from 1.7% to 1.4%, while year-end core PCE inflation was revised up from 2.8% to 3.1%. The unemployment rate projection increased from 4.4% to 4.5%. The Fed appears to believe inflation will converge to its 2% target more gradually than previously anticipated.

Meanwhile, according to CME FedWatch as of 11 a.m. that day, the probability that the Fed will hold rates unchanged in July is 89.7%. The first rate cut is expected in September, with a 64.7% probability.

Bitcoin, ETF Inflows & Price Gaps...“Market Caution Remains”

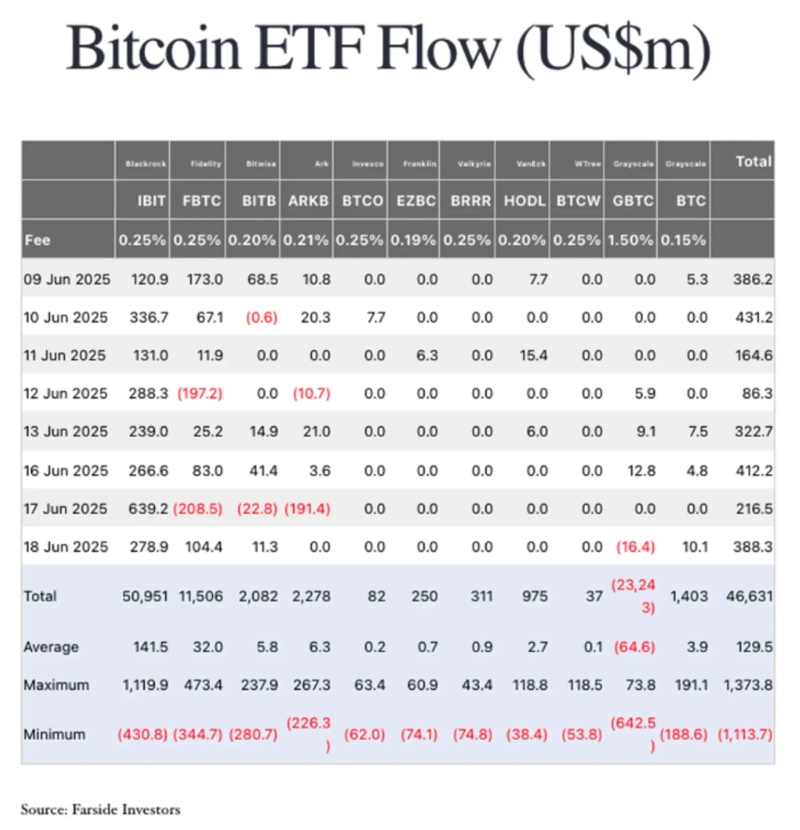

Despite heightened geopolitical tensions, last week’s inflows to spot Bitcoin ETFs continued. Total inflows last week reached $1.391 billion, reflecting continued strong buying momentum.

Anticipation for a sustained bull run is rising in the industry after the ‘GENIUS Act’, a stablecoin regulation bill, passed the U.S. Senate plenary session. The bill is viewed positively as it brings virtual assets into the scope of law and regulation.

On the other hand, concerns about possible U.S. military involvement in the Middle East are spreading, putting adjustment pressure on the market as well.

On-chain data platform Santiment reported on the 18th, “Unlike the initial panic from the Israel-Iran conflict, Bitcoin is currently maintaining relative stability in the $104,000–$105,000 range,” and emphasized, “Although Middle Eastern volatility is rising again, spot Bitcoin ETFs have seen net inflows for five consecutive trading days.”

However, despite ongoing ETF inflows, Bitcoin’s price stagnation may indicate that the market remains wary of both geopolitical risk and monetary policy.

The report stated, “This trend resembles the risk-off and stabilization patterns repeatedly observed in the past,” but added, “If Middle East-induced tensions are not resolved quickly, price behavior could become more unstable and difficult to predict.”

During Russia’s invasion of Ukraine in February 2022, Bitcoin also sharply dipped then rebounded in the short term. Similarly, after the Israel-Palestine conflict in October of the same year, Bitcoin briefly dropped 7% and then recovered within a few days.

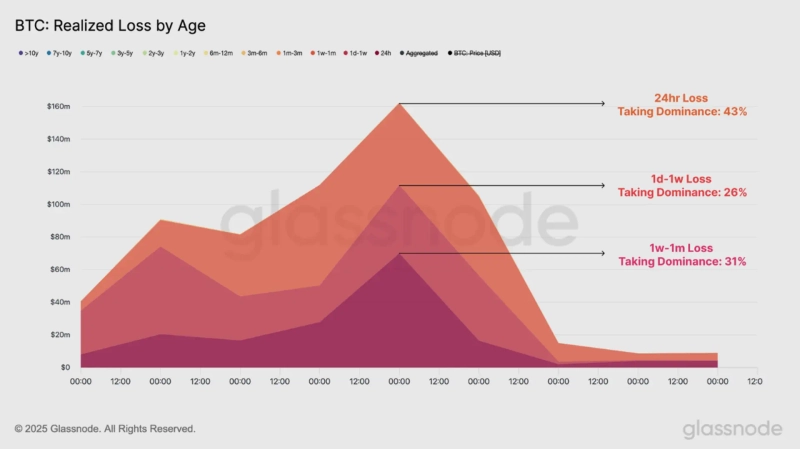

Despite recent corrections, some analyses suggest that the overall market response has been relatively calm. According to a weekly report from on-chain data platform Glassnode, “While market fear spiked temporarily, most of the recent stop-losses came from short-term investors. Capitulation signals were mainly observed among new investors within one month,” and “There were no clear signs of panic selling among investors holding for more than three months, and realized losses remained around $200 million.”

In derivatives markets, it’s noted that after many overheated leveraged positions were liquidated, the market stabilized in the short term. The report added, “Open interests in Bitcoin futures have decreased by over $2.3 billion (about ₩3.174 trillion) recently, marking the seventh-largest liquidation in this cycle. This correction was mainly driven by deleveraging in the futures market rather than on-chain activity.”

Open interest refers to the total number of outstanding contracts in the derivatives market. Usually, higher open interest corresponds to greater investor market participation and volatility.

Some also state that Bitcoin is absorbing short-term adjustment from geopolitical shocks while maintaining its trend. Global crypto exchange Bitfinex, in a recent research report, noted, “After Israel’s airstrikes on Iran, crypto investor sentiment briefly weakened, but this is just a correction phase within a bull trend. The market trend itself hasn’t collapsed.” It also said, “Despite recent shocks, the price drop was limited to about 9% from its peak, indicating that downside risk may remain limited even as investors continue to be cautious.”

“Bitcoin Tug-of-War Between Support & Resistance... Range-Bound for Now”

There is analysis that Bitcoin is searching for direction near its support level, digesting U.S. rate holds and Middle East shocks.

Experts warn that if key support breaks, the drop could extend to $94,000. Conversely, if buying momentum revives, Bitcoin may retest $110,000, $112,000, and even $120,000. On-chain analysts note that while Bitcoin’s futures open interest (OI) is declining, volatility expectations are rising.

With Bitcoin repeatedly failing to break through major resistance, short-term downward pressure has increased and direction remains unclear. Aayush Jindal, researcher at NewsBTC, said, “After plummeting from a high of $108,924, Bitcoin formed a short-term bottom at $103,400 and is trading within a narrow box range of $103,500–$105,500.” He added, “Bitcoin faces strong resistance near $105,500, limiting a rebound.”

He continued, “If Bitcoin stably breaks $105,500, it could stage a stepwise rebound through $106,200 and $108,000 up to $110,000. If it fails at $106,200, it will retest support at $104,200 and $103,500.” He further predicted, “If those supports break, the drop could extend to $102,650 and $101,200, ultimately falling to the psychological support at $100,000.”

With Bitcoin giving up recent gains, some analysts see continued ranging within a box for now. While there are some differences in view, most analysts see the $104,000–$105,500 range as the current key box region.

Rakesh Upadhyay, researcher at Cointelegraph, stated, “Bitcoin is locked in a tug-of-war between buyers and sellers near the $104,269 support. Buyers are aiming to establish higher lows, while sellers are looking to push the price down to the psychological level of $100,000.”

He said, “Though Bitcoin recently broke $105,800, it didn’t sustain the advance and was pushed down. If Bitcoin falls below $104,200 and $100,000, a further decline to $93,000 is likely.” He added, “If, conversely, Bitcoin rebreaks $105,800, it may rebound up to $112,800.”

With short-term buying and selling battling around support, the market is waiting for a clear direction. Christopher Lewis, a researcher at FXEmpire, said, “Bitcoin is forming support near $103,250, and investors could use this area as a base for short-term strategies.”

He concluded, “If support breaks, the psychological $100,000 level could be retested. If Bitcoin surpasses the upper resistance zone of $110,000–$112,000, the next target will be $120,000.”

Minseung Kang, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)