Virtual Asset Futures Market Sees Liquidations Exceeding $550 Million in the Past 12 Hours

Uk Jin

Summary

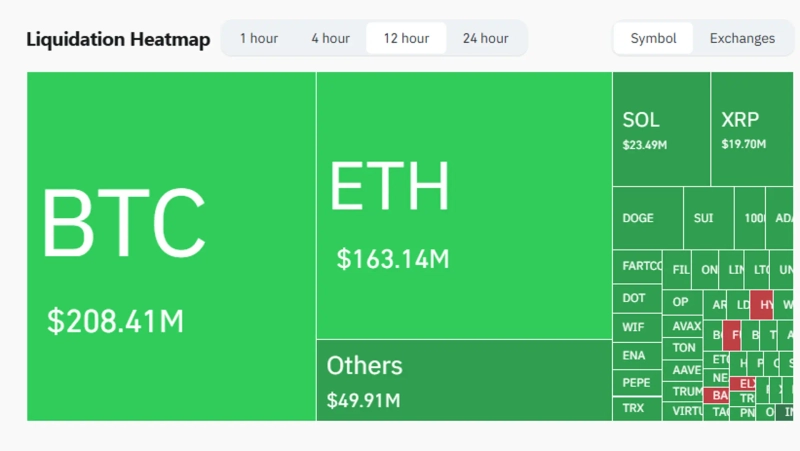

- It was reported that over $550 million worth of liquidations occurred in the virtual asset futures market in a short period due to geopolitical risks originating from the Middle East.

- Long positions accounted for the majority of the liquidations at $482.60 million.

- By virtual asset, Bitcoin had the largest liquidation volume at $208.41 million, with Ethereum, Solana, and XRP following behind.

The virtual asset (cryptocurrency) market is reeling due to geopolitical risks arising from the Middle East. With growing volatility, it was reported that positions worth $550 million (approximately ₩750 billion) were liquidated in the virtual asset futures market over the past 12 hours.

According to CoinGlass data at 6:12 a.m. on the 23rd (Korea time), a total of $552.11 million in positions were liquidated in the virtual asset market over the past 12 hours. Of that, long positions accounted for $482.60 million, making up the majority, while short positions amounted to $69.58 million.

Looking at liquidation volume by asset, Bitcoin led with $208.41 million, followed by Ethereum (ETH), Solana (SOL), and XRP.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)