Editor's PiCK

[Analysis] "Bitcoin Leverage Ratio Plummets to Levels Seen During China's Mining Ban"

Summary

- Due to increased geopolitical risks originating from the Middle East, the leverage ratio in the Bitcoin (BTC) futures market has dropped sharply.

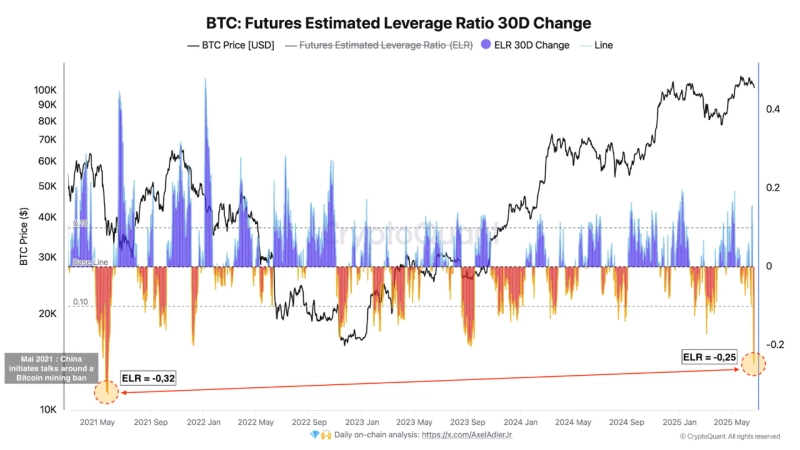

- The estimated leverage ratio (ELR) for Bitcoin has plummeted to -0.25, a level similar to that seen during China's mining ban in 2021.

- This decline reflects a rapid decrease in leveraged positions and open interest, and signals that traders’ leverage sentiment has weakened.

Amid escalating geopolitical risks originating from the Middle East, the leverage ratio in the Bitcoin (BTC) futures market has dropped significantly.

On the 23rd (KST), DarkPost, a contributor to CryptoQuant, published a report stating, "On this day, the estimated Bitcoin leverage ratio (ELR) plunged to -0.25," adding, "This is comparable to the level seen when China declared a ban on domestic Bitcoin mining." Previously, in June 2021, when China prohibited Bitcoin-related activities, the Bitcoin ELR fell to as low as -0.35.

DarkPost explained, "This downturn indicates that leveraged positions and open interest are rapidly decreasing in the market," noting, "It shows that traders’ appetite for leverage has significantly cooled."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)