Summary

- It was stated that Bitcoin dominance has reached its highest level this cycle, cementing its status as digital gold.

- The analyst reported that institutions and listed companies continue to choose Bitcoin as their core asset.

- Altcoins remain largely subject to individual speculative demand, and some of that demand has shifted to the stock market.

As Bitcoin (BTC) dominance hits its highest level this cycle, some argue that its position as digital gold has become even more entrenched.

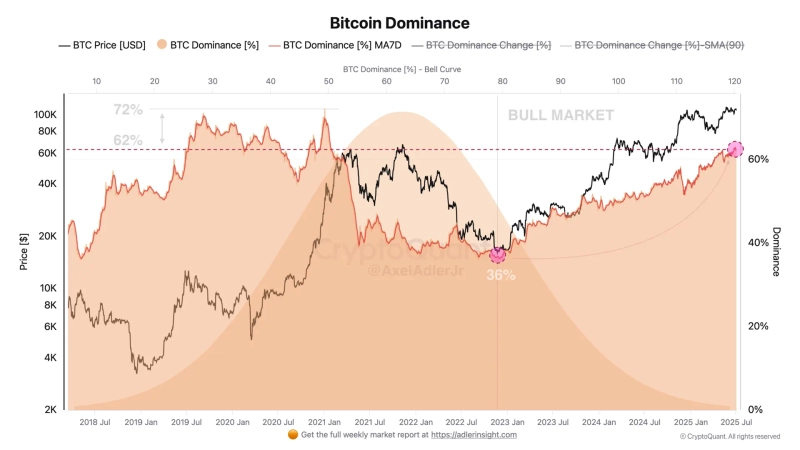

On the 2nd (local time), Axel Adler Jr, a contributor at CryptoQuant, stated on X (formerly Twitter), "In June, Bitcoin dominance rose another 1%, marking a new cycle high," adding, "For institutions, Bitcoin remains the core asset."

He continued, "Bitcoin has reclaimed most of the dominance that declined after the last alt season," emphasizing, "This means its status as digital gold has been further strengthened." He also noted, "Funds and listed companies alike now see it as a trusted store of value."

However, he explained that altcoins still only attract individual speculative demand. The analyst said, "Most altcoins are still held by individual speculators," and added, "With the rise of companies stockpiling Bitcoin, some of the speculative demand that once flowed to altcoins has moved over to the stock market."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)