Editor's PiCK

[Analysis] "Bitcoin: Individual buying remains 'active'... whales reduced holdings"

Summary

- According to a CryptoQuant analyst, buying led by short-term holders is currently very active in the Bitcoin market.

- In contrast, whales and long-term holders are reducing their holdings and exhibiting selling activity.

- These shifts in positions may drive the uptrend in the short term, but the cautious adjustments by whales suggest the possibility of increased volatility.

In the virtual asset (cryptocurrency) market, buying activity centered on short-term holders is expanding, while selling by whales and long-term holders is becoming pronounced, leading to an analysis that the upward momentum is slowing.

On the 5th (local time), Amr Taha, an analyst at the virtual asset analysis platform CryptoQuant, stated in a QuickTake report, "While short-term holders are significantly increasing their Bitcoin holdings in early July, whales and long-term holders are reducing their holdings."

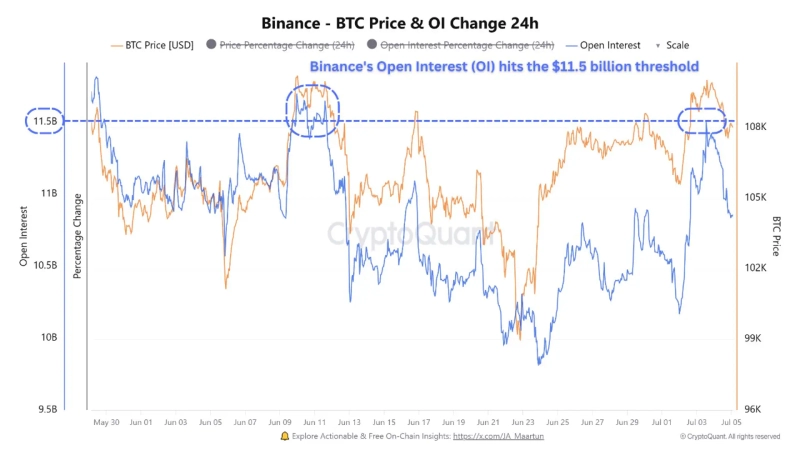

According to QuickTake, Binance Bitcoin futures open interest (Open Interest·OI) recently rose to around $11.5 billion and then began to decline. The analyst explained, "The repeated failure to break through this resistance level and the liquidation of futures positions suggests an exhaustion of the short-term uptrend."

Open interest refers to contracts in derivatives such as futures and options that have not yet been settled. An increase in open interest indicates new funds flowing into the market, while a decrease implies a contraction in investment sentiment due to position liquidation, among other factors.

Additionally, on-chain data shows that whale wallets holding more than 10,000 BTC sold about 12,000 BTC in a single day on the 3rd. Among the group holding 1,000 to 10,000 BTC, roughly 14,000 BTC were gradually sold since the 30th of last month, indicating a distinct trend of distribution among medium- and large-scale holders.

Conversely, short-term holders bought about 382,000 BTC additionally during the same period. The holdings of long-term holders decreased by a corresponding amount. This is being interpreted as a position rotation occurring within the market.

The analyst added, "After the recent release of U.S. employment and unemployment indicators, some individual investors are buying Bitcoin either in response to expectations for accommodative monetary policy or in reaction to economic uncertainty," and stated that, "In the short term, this demand can sustain the uptrend, but cautious position adjustments by whales may signal potential for increased volatility going forward."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)