Editor's PiCK

The Counterattack of Stablecoins... Changing the Investment Landscape and Policy

Summary

- Recently, stablecoin-related trademark applications and consortium discussions have been active across the fintech and financial sectors.

- The Bank of Korea's CBDC project has been temporarily suspended ahead of its second phase of testing amid the surging interest in stablecoins.

- The industry anticipates full-scale cross-sector cooperation in response to the institutionalization and commercialization of KRW stablecoins.

Scene 1.

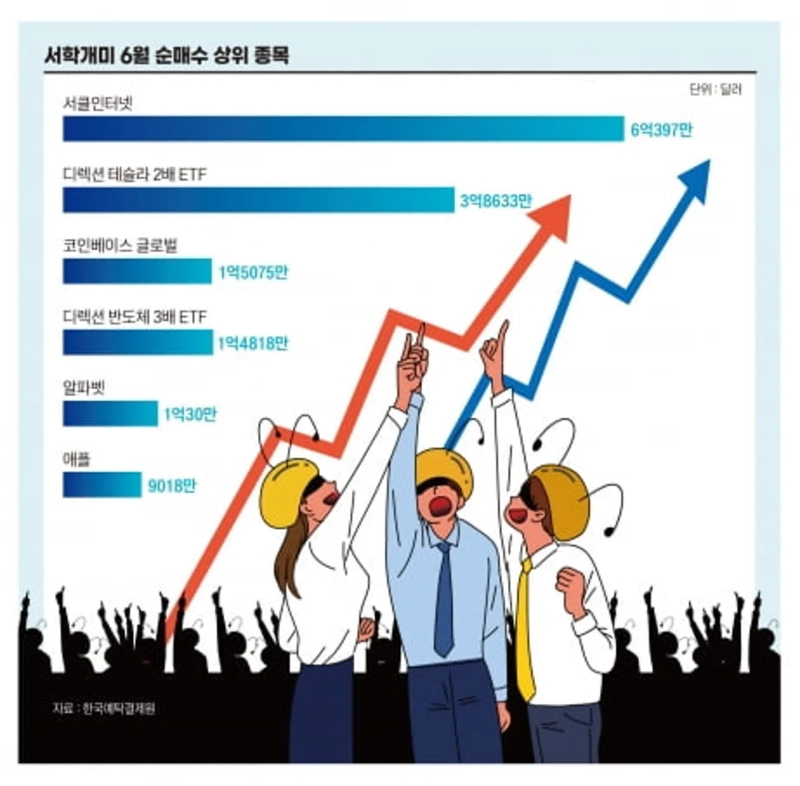

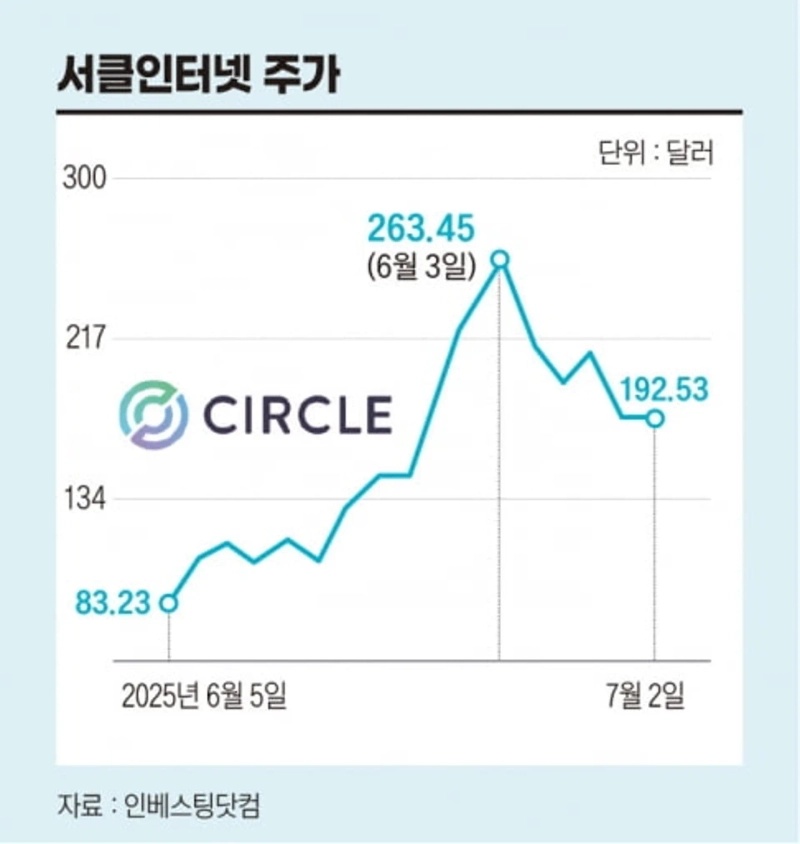

Dong-Young Kim (38), a retail investor in U.S. stocks, has recently experienced emotional ups and downs. On June 5, he invested in Circle Internet Financial, which is listed on the U.S. stock market. As the share price soared to more than nine times the IPO price ($31), he made a substantial profit. Excited, Mr. Kim decided to make an additional purchase, but subsequently suffered losses as the stock price plunged. Circle is the issuer of the USD-based stablecoin 'USDC.'

Joo-Mi Lee (35), who invests in the Korean market, has also been going through a rollercoaster month. She invested in Kakao Pay, regarded as a stablecoin-themed stock, and twice hit the upper trading limit in June, but right after the Bank of Korea warned about stablecoin risks, the share price sharply declined again. As of the July 2 closing price (77,400), it is down about 17% from its peak.

Scene 2.

“OO Bank stablecoin trademark filed,” “trademark race” ... such headlines have flooded the news recently. According to KIPRIS, the Korean Intellectual Property Rights Information Service, there have already been nearly 280 stablecoin-related trademark applications this year. Out of 23 applicant companies, Toss Bank submitted the most with 48 filings.

Scene 3.

Ha-Young Park (55) purchased a cup of coffee at a Starbucks in Gangnam, Seoul, using a stablecoin card (RedotPay) linked to Apple Pay. RedotPay is a stablecoin payment card pegged one-to-one with the U.S. dollar. When paying with this card, stablecoins are instantly deducted in real time from a digital wallet. Ms. Park said, “The physical card is a bit expensive at $100 to issue, but the virtual card can be issued immediately for just $10, and it’s convenient because it can also be registered on Apple Pay.” She added, “I also use stablecoins to send living expenses to my child studying abroad. Its advantage is the ability to remit money quickly with low fees.”

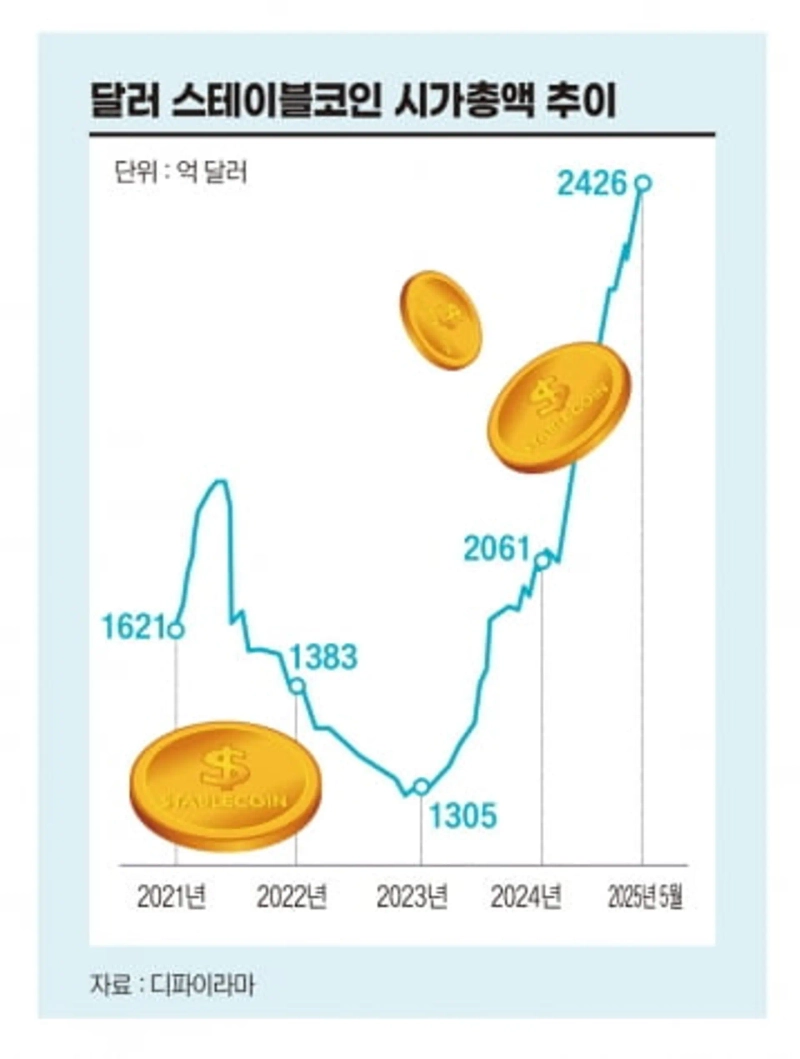

Since the beginning of this year, the market capitalization of stablecoins has increased by nearly 20%, surpassing $240 billion. As their use expands from investment to payment and remittances, both companies and individuals are paying more attention. Institutionalization is also gaining pace, with bills being proposed and discussions on KRW stablecoins underway.

◆ The 'Stablecoin' Stone Thrown by the U.S.

Stablecoins peg their value to assets such as the U.S. dollar, meaning that at issuance, reserves like U.S. Treasuries, dollars, or gold must be secured. With virtually no price volatility, stablecoins serve as reserve currencies in the crypto market.

President Donald Trump has opposed the central bank digital currency (CDBC) that the Joe Biden administration sought to develop, instead emphasizing stablecoins as a tool to maintain the dollar's hegemony. In order for the dollar to remain a key currency, a trade deficit is inevitable because dollars must keep flowing and being used overseas. Meanwhile, the U.S. government's budget deficit continues to exceed $1 trillion annually. The U.S. Department of the Treasury must keep issuing Treasuries to cover the deficit, but recently, major buyers like China have sharply reduced their purchases. When demand falters and Treasury yields rise (with Treasury prices falling), the government’s interest expenses also increase.

The Trump administration viewed stablecoins as a “brilliant solution” to absorb U.S. Treasuries. Currently, 99% of stablecoins in circulation are pegged to the dollar, with most backed by U.S. Treasuries. Tether (USDT), USD Coin (USDC), and others are typical examples. Tether Limited holds more than $100 billion in U.S. Treasuries, making it a major player. The more stablecoins are distributed, the more Treasuries are purchased, potentially reinforcing the dollar’s dominance.

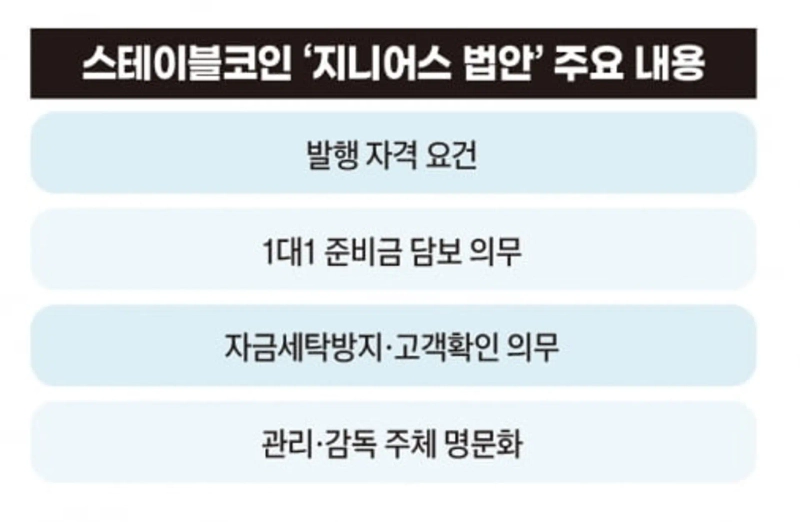

On June 17, the U.S. Senate passed the relevant bill, the Genius Act. Only a House vote remains. The bill allows not only banks, but also credit unions and non-bank institutions to issue stablecoins if authorized by federal or state governments.

◆ Securing Monetary Sovereignty vs. Doubts About KRW Coins

The Treasury Borrowing Advisory Committee (TBAC) forecasts the U.S. dollar stablecoin market to grow from $242.9 billion in May to about $2 trillion by 2028 (an 8.3-fold increase from 2025).

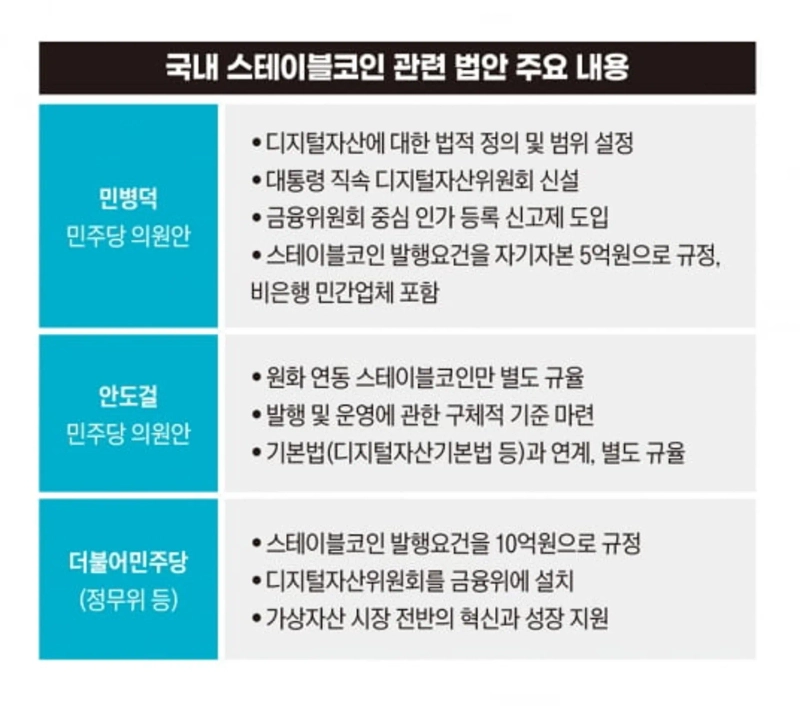

In response, countries around the world are working to issue stablecoins based on their own currencies, aiming to reduce dollar dependence and strengthen “currency sovereignty.” Japan established regulatory frameworks for stablecoins early on, driving the financial sector, and Hong Kong is also pursuing regulations such as a regulatory sandbox. The European Union (EU) is incorporating stablecoins into the regulatory system through the MiCA (Markets in Crypto-Assets Regulation), which governs stablecoin issuance and public offerings. In Korea, discussions are rapidly advancing after the presidential election. The Jae-Myung Lee government, following its inauguration, has been pushing for the institutionalization of stablecoins, linking the value of the coin to legal tender (“1 coin = ₩1,000”). The ruling party has proposed several relevant bills. Byung-Deok Min, a lawmaker from the Democratic Party of Korea, introduced the “Digital Asset Basic Act,” which stipulates requirements for stablecoin issuance (₩500 million in self-capital, including non-bank private companies) and a Financial Services Commission approval system. Do-Geol Ahn, another lawmaker from the Democratic Party, proposed a bill mandating 100% collateralization of KRW stablecoin issuance.

However, there are widespread doubts about whether KRW stablecoins, which are not based on a key currency, can truly succeed. In its report, HSBC, a global investment bank, analyzed that expansion will be limited due to the KRW’s low status in international settlements, Korea’s already well-established payment system, high credit card use, and strict financial regulations.

Chang-Yong Lee, Governor of the Bank of Korea, recently attended the European Central Bank (ECB) forum and noted: “The very presence of KRW stablecoins may make conversion to dollar stablecoins easier, which could ultimately lead to even greater use of dollar-pegged stablecoins.”

◆ What Safety Nets Exist to Prevent Coin Runs?

The Bank of Korea and the Bank for International Settlements (BIS) are raising warnings about the spread of stablecoins, citing concerns about financial stability and broader economic risks. The Bank of Korea, in its semiannual financial stability report, pointed out that stablecoins are vulnerable to damage in the credibility of reserve assets, which could lead to coin runs (large-scale withdrawals). It warned that no safety net currently exists to prevent this. A coin run could trigger mass sales of government bonds and shock the financial market, and central bank monetary policy could be undermined. The spread of private-sector currency-based stablecoins could reduce trust in fiat currency and weaken banks’ credit creation, ultimately limiting the effectiveness of monetary policy.

The BIS, regarded as the “central bank of central banks,” raised similar concerns about price instability, coin runs, and capital outflows from emerging markets (draft annual report).

According to the Hana Institute of Finance, from December 2024 to April 2025, during a period of increased financial market volatility due to domestic and international uncertainties, the scale of funds flowing overseas from Korean exchanges via stablecoins is estimated at around ₩50.3 trillion.

◆ Is Private Currency Circulation Okay?

The BIS compared stablecoins to private banknotes issued during the era of “free banking” in 19th-century America. From 1837 to 1863, for 27 years, all private banks in the U.S. issued their own money backed by government bonds, gold, or silver, after President Andrew Jackson refused to reauthorize the Second Bank of the United States as central bank. Notes issued by less credible and less stable banks were not accepted as having value, undermining the singularity of currency (all money having equal value). Some banks collapsed after issuing money without sufficient collateral.

By referencing an event from 200 years ago, the BIS is warning that allowing private-sector money issuance may damage the “principle of unconditional acceptance” of currency issued by central banks. There is also a view that the effectiveness of policy rates could be limited. Even if the Bank of Korea cuts rates to stimulate the economy, should coin issuers offer higher rates for KRW, liquidity could be locked up.

◆ Bank of Korea Halts CBDC

Although regulation and legal frameworks are still in their infancy, stablecoins are attracting strong interest in the market. Their appeal lies in enabling faster and cheaper cross-border transactions.

Competition for stablecoin trademarks based on the Korean won is heating up among both financial institutions and fintech firms. While registering a trademark doesn’t guarantee immediate commercialization, they are nonetheless taking preemptive steps.

Cases of cooperation between fintech firms and banks are emerging. Hashed, a blockchain investment firm, is reported to be discussing consortium formation for stablecoin issuance with major financial holding companies. Should incorporation into the institutional sphere become clear, more alliances are expected between banks, fintech companies, and the broader non-banking industry. Meanwhile, the Bank of Korea’s CBDC project has been put on hold ahead of its second phase of testing, likely pushed aside by the stablecoin wave. The Bank of Korea explained: “Due to increased project uncertainty, there was a discussion to watch and wait for now.” Since a CBDC would be issued by the central bank, it is considered more credible and stable than privately issued stablecoins.

Commercial banks, which have invested billions of won in these experiments, are reportedly dumbfounded. A bank industry official said, “We are quickly working on trademark applications and preparing for KRW stablecoin issuance, but the framework for stablecoin-related systems needs to be established soon so we can organize personnel.”

Tae-Rim Kim, Reporter tae@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)