Korean Companies on Edge... How Far Will the 'Butterfly Effect' of Trumpian Tariffs Spread? [Global Money X-File]

Summary

- The imposition of reciprocal tariffs by former President Trump has raised concerns over global supply chain disruptions and rising costs.

- The US’s reinforcement of tariffs on critical resources such as rare metals, battery raw materials, and apparel is expected to squeeze Korean companies’ profitability and push up production costs.

- Notably, **higher tariffs on Bangladesh, Cambodia, and Thailand—key production bases—are forecast to deliver a major blow to Korean apparel and HDD-related businesses.

Summary

·Concerns over global supply chain disruptions due to Trump’s reciprocal tariffs

·Tariffs on resource-rich nations impact costs for electric vehicle and battery makers

·Tariffs on Bangladesh and Cambodia hurt Korean apparel firms

Recent analyses suggest that the reciprocal tariffs announced by former President Donald Trump on various countries will create a range of ripple effects across the global economy. Sectors such as raw materials, apparel, and HDD (hard disk drive) are expected to be significantly affected. There are concerns that relevant domestic companies could be directly hit.

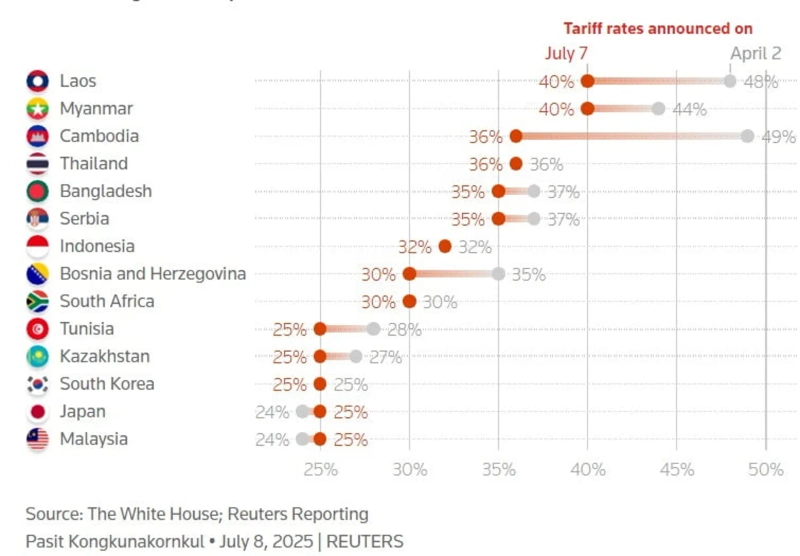

According to foreign media reports on the 9th, President Trump sent a 'tariff letter' to 14 countries on the 7th (local time), indicating country-specific reciprocal tariffs of 25–40%, and notified that these would be imposed from August 1. On the same day, he also signed an executive order extending the grace period for reciprocal tariffs on trade partners from July 9 to August 1. While Korea and Japan have been the focus, it is noted that tariffs on other countries also merit attention.

US Tariffs Shake Core Commodity Supply Chains

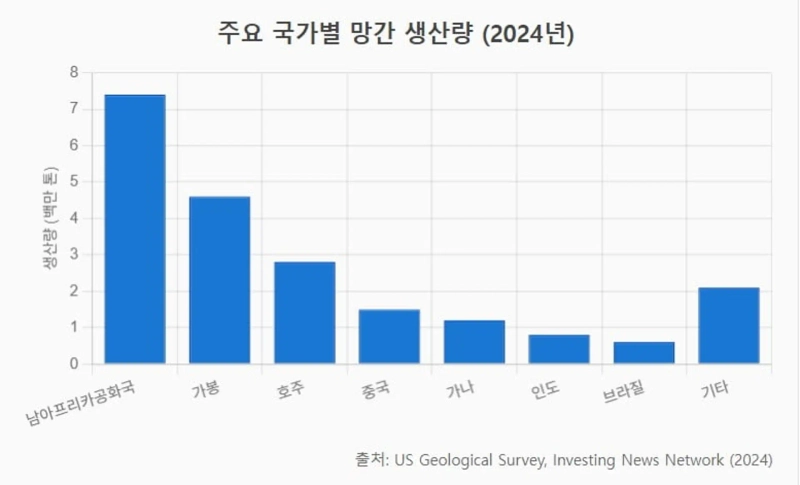

The United States imposed an additional 30% tariff on South Africa. As a result, there are fears that core mineral supply chains for electric vehicle batteries and hydrogen vehicles, including manganese, platinum, and palladium, may be shaken. South Africa is the world’s largest producer, accounting for about 36% of global manganese output, and supplies roughly 70% of global platinum production.

According to the global trade data site OEC, the US imported $3.7 billion worth of platinum from South Africa last year, constituting more than half of total US platinum imports. If these tariffs go into effect, US importers will either seek alternative suppliers like Russia or be forced to bear the added costs.

However, imports of related raw materials from Russia have been limited due to sanctions following the Russia-Ukraine war. For manganese, the US has no domestic production and has relied 100% on imports, so higher tariffs may lead to increased costs across global steel and battery industries.

Related Korean companies are also expected to be impacted. Korea partially relies on South African resources for manufacturing electric vehicle batteries and hydrogen vehicles, with manganese being a key material for Korean battery companies. If the global price of manganese rises due to these tariffs, Korean battery and finished electric vehicle prices may also face upward pressure.

Previously, the World Trade Organization (WTO) warned that high US tariffs could shrink global trade, predicting a –0.2% contraction in global goods trade this year.

Korean Firms’ US Plants Also Hit

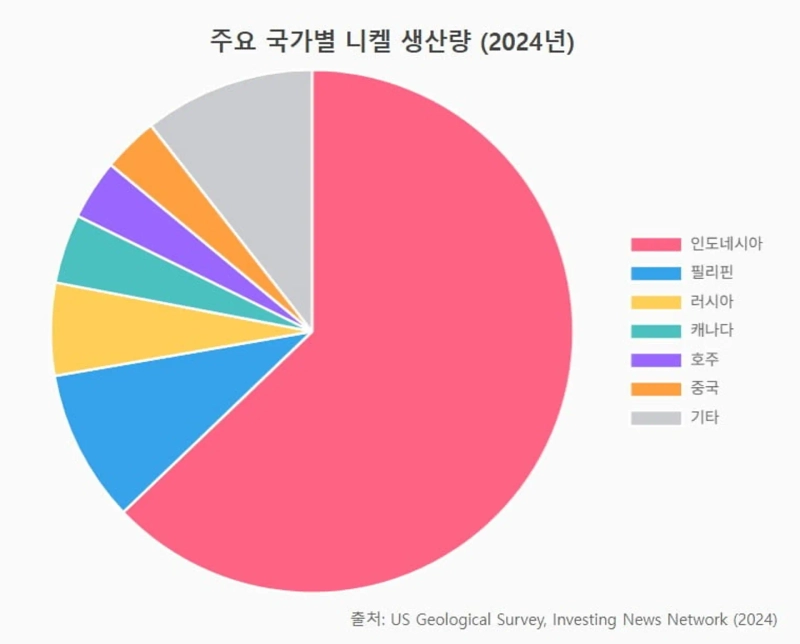

Indonesia faces a similar situation, as the US announced a 32% reciprocal tariff. Indonesia is a nickel powerhouse, producing 2.2 million tons of nickel last year, over 50% of the global supply, and possesses about 42% of the world's nickel reserves.

With these tariffs, direct exports of Indonesian nickel to the US are expected to become virtually impossible. While the US import ratio from Indonesia is smaller than from Canada or Norway, moves by US importers to secure alternative supplies could push up nickel prices.

Korea’s battery industry will also take a direct hit, as nickel is a core material for secondary batteries. Lacking domestic nickel mines, Korea has imported intermediates from Australia, Canada, Indonesia, and others, with major investments in Indonesia.

Some Korean firms manufacture in the US. If they import Indonesian nickel, US tariffs would add over 30% in costs, unavoidably worsening profitability for Korean joint ventures established in America.

The WTO has stated that the expanded US tariffs could violate multilateral trade rules and that affected countries like Indonesia may file disputes.

The US's 40% tariffs on Laos and Myanmar reportedly aim to block indirect exports of rare metals and minerals such as rare earth elements and tin. Myanmar has played a central role in China’s rare earth supply chain, producing about 60% of global supplies of dysprosium (Dy) and terbium (Tb) used in electric vehicle motors and wind turbines.

China, amid environmental regulations suppressing domestic mining, has relied on imports from Myanmar and others. US tariffs are intended to block routes from China, through Myanmar, to the US.

Myanmar’s tin industry is also a target—the country was once the world’s third-largest producer, and much of the tin smelted in China originated from Myanmar. Tin is key for solder in semiconductor packaging, battery packs, and more. There have been allegations that China blended Myanmar-origin tin to avoid US tariffs on Chinese tin.

US Blocks Indirect Chinese Exports

The US has imposed a 40% tariff on rare metals from Laos, reportedly targeting China’s route of sending resources via Laos and Thailand—potentially sending rare earth prices higher.

Korean companies in semiconductors, displays, secondary batteries, and electric vehicle motors depend heavily on imported rare earths and tin, predominantly from China. If indirect supplies from Myanmar or Laos are reduced by US tariffs, China may prioritize domestic needs and reduce exports to Korea and other third countries.

Serbia, facing a 35% reciprocal tariff, is a relatively minor US trade partner but a key supplier of strategic resources such as lithium and copper. Serbia has Europe’s largest lithium deposits, and its Bor mine produces hundreds of thousands of tons of copper annually. With the 35% US tariff, supply chains in North America and Australia are expected to be strengthened as alternatives.

The US’s 35% tariffs on Bangladesh are expected to impact the global apparel industry. Bangladesh is the world’s second-largest apparel exporter, after China. According to the US Office of Textiles and Apparel (OTEXA), Bangladeshi apparel exports to the US rose 0.75% year-on-year to $7.34 billion last year.

If the US levies a 35% tariff on Bangladeshi garments, American apparel retailers may relocate production bases to other countries such as Vietnam and India, reversing the trend that saw orders shifting from China to Bangladesh during the US-China trade dispute in 2019.

Bangladesh is also a major production base for Korean SPA brands and apparel OEM firms. A 35% tariff on US-bound shipments is expected to force price reductions or order declines, raising concerns over lower utilization rates and reduced profits for Korean sewing factories operating in Bangladesh.

Global Apparel & Footwear Manufacturing Bases Also Hit

Cambodia, a key low-cost production base for apparel and shoes, has been a major procurement center for US SPA brands, but a 36% tariff is likely to erode its competitiveness. As the EU partially withdrew preferential tariffs for Cambodia in 2020, dependence on the US market has grown.

Korean firms operating over 70 sewing OEM factories in Cambodia are also facing difficulties. These produce for US apparel brands.

Thailand, also facing a 36% tariff, is a key global production hub supplying about 80% of HDDs. US companies Western Digital (WD) and Seagate manufacture HDDs at Thai plants. With 36% tariffs on Thai HDDs, American server companies and big tech firms will inevitably see higher costs.

With limited options for alternative manufacturing sites in the short term, US data center construction costs will rise, and cloud storage prices may follow suit. During the flood in Thailand in 2011, global HDD prices nearly doubled when supply was disrupted. Korean data center construction costs and cloud service fees may face similar upward pressure.

Reporter: Joo-Wan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)