Editor's PiCK

Bitcoin in Wait-and-See Mode Ahead of $110,000 Resistance... Focus on Breakthrough [Kang Min-seung's Trade Now]

Summary

- Bitcoin is said to be forming a range and remaining in a wait-and-see mode ahead of the $110,000 resistance.

- Market experts warn that if $108,500 is breached upward, further upside potential exists, but if key support is lost, a correction to the low $100,000s is possible.

- Although there are concerns over decreased trading volume and volatility with short-term corrections, investor sentiment remains bullish supported by ETF inflows and on-chain accumulation.

Bitcoin (BTC) faced short-term correction pressure after former President Trump of the United States announced high tariff notifications, but is now seeking new direction around the $110,000 mark. In the market, there is an evaluation that the rebound trend has not faltered and that the buying momentum could be sustained for a certain period. However, since there are also suggestions of a breather after the recent short-term rise, analysts emphasize that a selective approach in pullback zones is important.

Market experts believe that if Bitcoin can settle above $108,500, there is a high possibility it will attempt to break $110,000 again. Conversely, if the key support level at $103,500 is breached, there is also a possibility that a correction may extend to the lower $100,000s.

As of 20:05 on the 9th, according to Binance USDT market data, BTC is trading at $108,893, up 0.02% from the previous day (₩148,490,000 on the Upbit KRW market). At the same time, the Kimchi Premium (the price gap between foreign and Korean exchanges) recorded a reverse premium of -0.48%.

Time Gained for Tariff Negotiations…Expectations for Increased Liquidity

Global stock and virtual asset (crypto) markets saw temporary correction pressure as President Trump sent a letter announcing high tariffs to 14 countries, including Korea and Japan. However, there is also an opinion in the market that "the negotiation period before implementation has been extended," resulting in a partial recovery of losses.

President Trump announced on Truth Social on the 8th (local time), "I sent letters to multiple countries yesterday, and tariff payments will begin on August 1, 2025." Bloomberg analyzed, "There still appears to be room for changes through negotiations, and Asian countries will have about three more weeks for tariff talks." However, uncertainty around the method and exceptions for tariff application remains.

Separately, the 'One Big Beautiful Bill Act (OBBBA)' signed by President Trump on the 4th is raising expectations that increased money supply will be triggered through tax cuts and expanded fiscal spending. Notably, as the US government's debt ceiling was raised by $5 trillion, some of the uncertainty in fiscal management has reportedly eased.

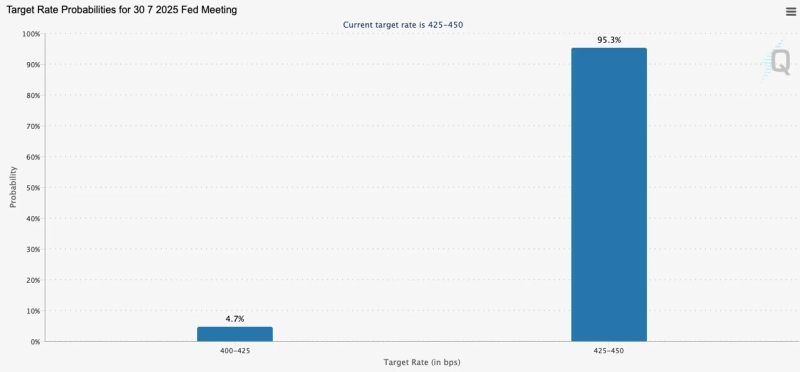

Expectations are also mounting for a gradual easing of monetary policy. According to CME FedWatch, as of 20:00, the US central bank, Fed, is forecast to keep interest rates unchanged in July with a 95.3% probability. The first rate cut is likely to occur in September, with odds of 62.9%.

On-chain Accumulation and Continuous Institutional Inflows… Market Remains in Wait-and-See Mode

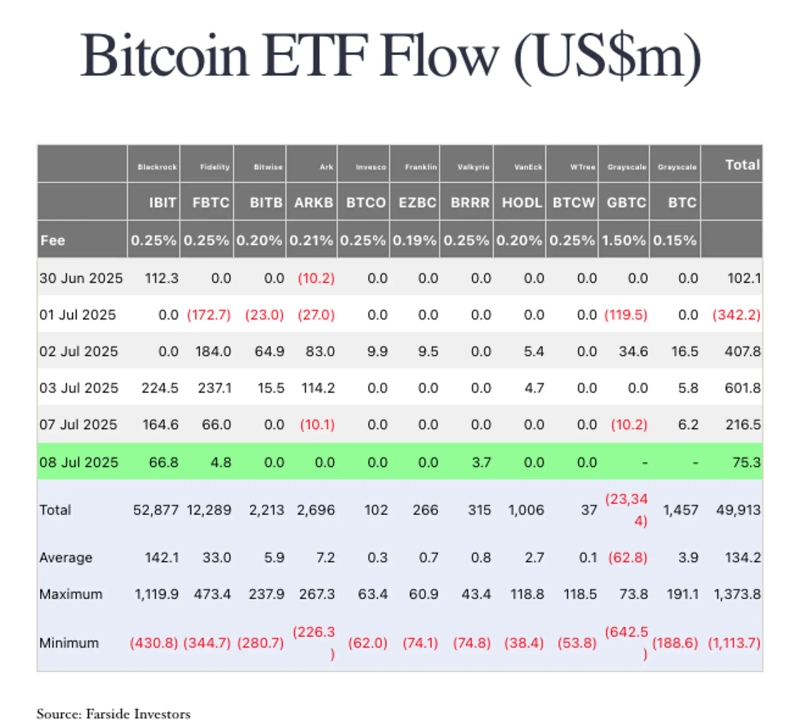

Bitcoin spot exchange-traded funds (ETFs) saw a total net inflow of $769.5 million (approx. ₩1,053 billion) last week. In addition to Iran and Israel reaching a conditional ceasefire agreement, the U.S. House of Representatives is scheduled to mark a 'Virtual Asset Week' from the 14th and push forward three core bills (Clarity, Genius, CBDC Prohibition Act), lending further support to the uptrend.

On-chain analytics firm Santiment noted, "While some investors are still betting on a decline and the recent MVRV indicator has entered a somewhat risky territory, the probability of a sharp correction in the short term remains low." The firm added, "Considering the average rate of return for investors and the Relative Strength Index (RSI), this is a favorable period for considering additional Bitcoin purchases or position expansion."

Market sentiment has also somewhat calm since the Middle East geopolitical tensions eased. Santiment said, "After the recent Israel-Iran ceasefire announcement, whales, smart money, and retail investors have all regained confidence simultaneously. Over the past week, all market participants have accumulated about 25,000 BTC. The total holdings of whale wallets increased 1.2% (about 160,810 BTC) since April."

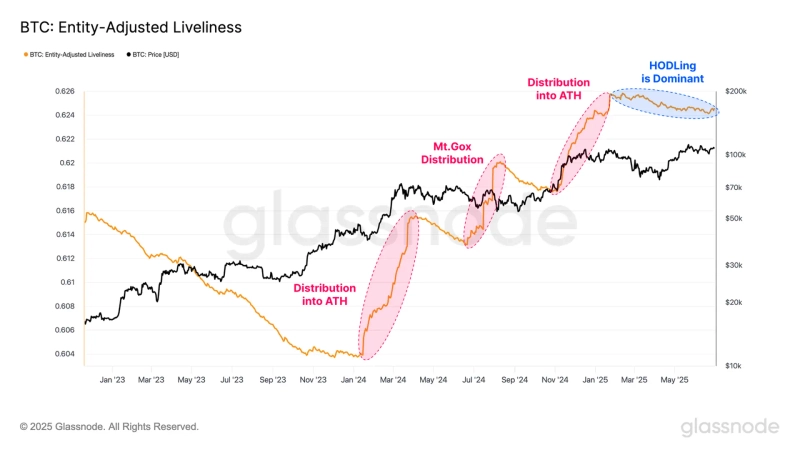

On-chain analytics firm Glassnode also stated in its weekly research report, "After Bitcoin surpassed $107,000, most investors have returned to an unrealized profit zone. Institutional capital inflow via ETFs continues robustly, and strong bullish sentiment inside the market remains valid." According to Glassnode, unrealized profits on-chain currently amount to about $1.2 trillion (approx. ₩1,641 trillion).

Glassnode added, "At current price levels, the tendency is more toward holding than profit-taking, with market participants putting more weight on a resumption of upward movement." It was also interpreted that stablecoin inflows at major virtual asset exchanges remain at neutral levels, indicating a balanced phase between buying and selling.

The market is showing a wait-and-see approach ahead of a direction decision. Global crypto exchange Bitfinex stated in its weekly report, "Bitcoin is searching for direction in the $100,000-$110,000 range, and as the upper breakout is delayed, whale holdings and open interest (OI) have slightly decreased over the past week. This signals a more cautious short-term stance by the market." OI refers to the total size of outstanding contracts in derivatives such as futures and options, and a decrease indicates that investors are less actively entering new positions.

Bitcoin's trading volume and volatility have been declining, resulting in a comparatively quiet market. Glassnode noted, "There are signs of a typical summer slowdown in the Bitcoin options market. Implied volatility (IV) has reached record lows across the board, from one-week to six-month contracts. This is the lowest level since mid-2023." Eric Balchunas, Bloomberg ETF analyst, also recently assessed that Bitcoin's medium-term (60-day) volatility has dropped to levels similar to the S&P 500.

"$110,000 Resistance Line... Need Secure Breakthrough at $108,500"

Analysis suggests that Bitcoin is repeating short-term range movements after repeatedly hitting selling pressure around $110,000. As battles continue around key support levels, there is cautious talk in the market about a potential breakout to the upside.

Market experts warn that if key support levels are broken, the drop could extend to $100,000, while on the other hand, if buying momentum returns, the possibility remains for Bitcoin to retest $110,000, $112,000, or even $120,000.

Ayushi Jindal, NewsBTC researcher, said, "Bitcoin has faced resistance again near $110,000 recently, halting its upward trend. However, if Bitcoin securely breaks through $108,500, it could re-test the $110,000 resistance." Especially in the medium term, if the $103,500 support holds, the price could rise up to $115,000.

She commented, "If the uptrend continues, there is a possibility of reaching $112,000 and $115,000, but if Bitcoin fails to clear $108,500, it may fall to $107,500, then to the $106,500-$105,500 range, and finally to $104,200."

Bitcoin remains in a period of absorption ahead of the upper resistance. Christopher Lewis, an FXPro analyst, said, "Currently, Bitcoin is testing the $110,000 resistance in the short term, gathering strength in that zone. This area continues to serve as strong resistance, and no clear breakthrough momentum is apparent." He emphasized, "While it is still a strong range-bound (consolidation) movement, I prefer a buy-on-dip strategy over a short (sell) position." He further added, "If Bitcoin breaks through the $110,000-$112,000 resistance technically, a sharp rally to $120,000 is possible, though the $100,000 mark will be the key medium-term support."

Despite the short-term correction, expectations remain for Bitcoin to attempt an upward breakout. Rakesh Upadhyay, Cointelegraph researcher, commented, "Bitcoin is currently in a narrow range between $107,211 and $110,530, but hasty profit-taking is not evident. Such narrow volatility often does not last long—some analysts interpret that a breakout is imminent."

Indeed, John Bollinger—the creator of Bollinger Bands—stated on X (formerly Twitter) on the 7th, "It appears Bitcoin is preparing for an upside breakout." A Bollinger Band is an indicator that visualizes price volatility by applying standard deviations to the upper and lower bands over a set period—when the band narrows (contracts), it signals a heightened possibility of a trend shift.

Upadhyay added, "If Bitcoin drops below the $107,211 support, there is a short-term possibility of declining to $104,500 or $100,000; however, if (based on daily closing price) Bitcoin breaks through $110,530, there is potential for an increase to $111,980, and up to $150,000."

Kang Min-seung, BloomingBit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)