'Unstoppable Momentum' in Korean Stock Market... Market Cap Surpasses ₩3,000 Trillion for the First Time in History

Summary

- The market capitalization of the domestic stock market surpassed ₩3,000 trillion for the first time in history.

- The recent upward trend in the KOSPI index and the increase in the number of listed shares were cited as the main reasons for the market cap expansion.

- Korea Investment & Securities raised its upper forecast for KOSPI in the second half, suggesting the potential for further gains depending on improved sentiment and policy measures.

Total Market Cap Recorded at ₩3,020.7694 Trillion as of Market Close on the 10th

Indexes Rise with Reduced Uncertainty... Number of Listed Shares Also Increases

KOSPI Just 4.17% Away from Its All-Time High

"KOSPI Upper Ceiling Could Reach 3,550 in the Second Half"

The market capitalization of the Korean stock market (KOSPI, KOSDAQ, KONEX) surpassed ₩3,000 trillion for the first time in history on the 10th.

According to the Korea Exchange, the total market capitalization of domestic markets was recorded at ₩3,020.7694 trillion.

By market, the KOSPI market cap was ₩2,603.7392 trillion, while those of KOSDAQ and KONEX were ₩413.8598 trillion and ₩3.1704 trillion, respectively.

This is the first time that the market cap of the Korean stock market has entered the ₩3,000 trillion range. The KOSPI market cap, which was ₩1,963.3288 trillion at the end of last year, climbed above ₩2,000 trillion at the beginning of this year and expanded to over ₩2,500 trillion by the end of last month.

The recent increase in overall market cap is largely attributed to the ongoing upward momentum of KOSPI and KOSDAQ indexes. The KOSPI index has continued its winning streak for four consecutive months from April to this month, based on monthly data.

The monthly return for April was 3.04%, which jumped to 5.51% in May and 13.86% in June. During this period, its growth rate ranked the highest among the major global developed market indexes.

The increase in the number of listed shares also played a role. On this day, the number of shares listed on the Korean market was 120.47642 billion, up from 119.35495 billion at the end of last year.

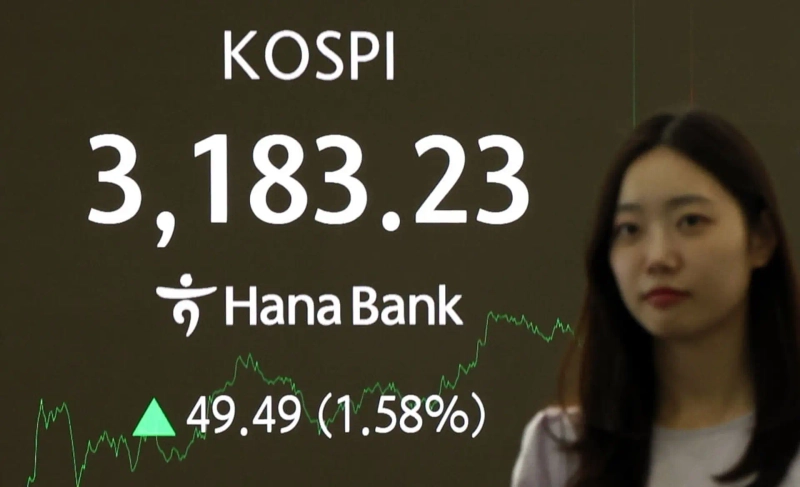

With the KOSPI index hitting fresh all-time highs day after day, attention is now on whether it can surpass its historical peak. The all-time intraday high of KOSPI was 3,316.08 points, set on June 25, 2021, during the COVID-19 pandemic. From today's close (3,183.23 points), it needs to climb more than 4.17% to break the record.

Korea Investment & Securities revised their KOSPI range forecast for this year’s second half from the previous 2,600~3,150 up to 2,900~3,550.

Kim Dae-jun, a researcher at Korea Investment & Securities, evaluated, "If you apply EPS and PER, and use the 35% dividend payout ratio suggested by the government, the appropriate PER for KOSPI is 11.6x," adding, "Taking into account improved sentiment and policy effects, the index is highly likely to reach those levels."

No Jeong-dong, Korea Economic Daily reporter dong2@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)