Lee Chang-yong hints at adjusting the pace of interest rate cuts..."Need to confirm home price declines"

Summary

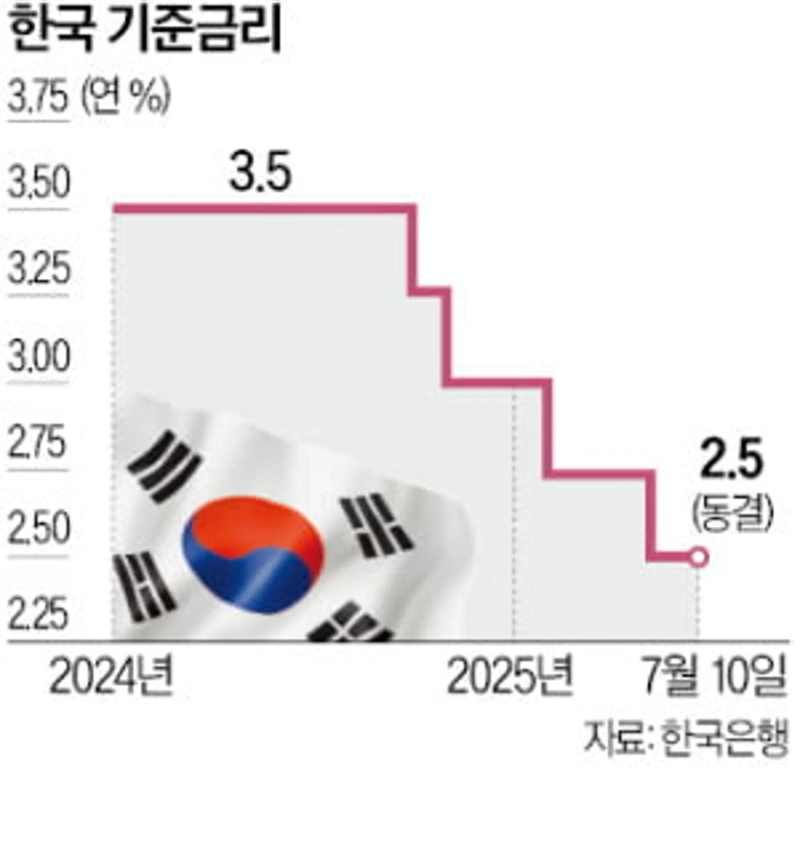

- The Bank of Korea kept the base interest rate steady at 2.50% per annum, citing household debt and rising home prices as major considerations.

- Governor Lee highlighted that housing price stability is a key variable determining the pace of potential rate cuts.

- While some Monetary Policy Committee members mentioned the possibility of a rate cut within three months, the rise in home prices and U.S. tariffs are expected to be variables.

Lee Chang-yong: "Current household debt is at a threshold level that hinders consumption and growth"

The BOK keeps the base rate unchanged at 2.50% per annum

The Bank of Korea held its base interest rate steady at 2.50% per annum on the 10th. The surge in household debt driven by rising home prices has hindered further rate cuts. Lee Chang-yong, the Governor of the Bank of Korea, assessed, "The current household debt is at a threshold level that significantly restricts consumption and growth."

The BOK made this decision during a Monetary Policy Committee meeting on monetary policy direction held at its main building on Namdaemun-ro, Seoul. Immediately after the committee meeting, Governor Lee explained in a press briefing that "the reason for holding the rate was that the housing market is showing signs of overheating, causing financial stability risks to rise sharply in the short term." The decision was unanimously agreed upon by all Monetary Policy Committee members.

Governor Lee stated, "The real estate issue is closely related to social problems such as low birth rates and concentration in the Seoul Capital Area," and explained, "even if it sacrifices some economic stimulus, the policy priority is to prevent housing prices in the Seoul Capital Area from rising."

He judged that the slump in growth has eased somewhat. He said, "With political uncertainties resolved, economic sentiment has improved," and "semiconductor exports are also continuing to fare well." However, he pointed out that tariff measures imposed by the Donald Trump administration in the United States have become a variable.

Governor Lee added, "We must prepare for the possibility that growth rate forecasts could decline due to tariff increases," and "in the worst case, if home prices don’t fall and growth prospects decrease, the deliberation for Monetary Policy Committee members will become even greater."

Within the next three months, out of six committee members, four said that “the possibility of a rate cut should be kept open.” The intention is to keep the door open for a potential rate cut while assessing the effects of tariff negotiations and real estate lending policy management. The other two members said, “Considering the Korea–U.S. interest rate gap (2.0 percentage points), it’s better to keep the rate unchanged even after three months.”

First Monetary Policy Committee of the second half, base rate held at 2.5% per annum

"Home prices are rising faster than last year, and it’s uncertain if the issue will be resolved by August"

"Even if household debt growth slows, we need to see whether home prices fall. Can that issue (home prices) be resolved by August, which would allow a (rate cut)? It’s a very difficult question." On the 10th, after deciding to keep the base rate at 2.50% per annum at the Monetary Policy Committee’s policy direction meeting, Governor Lee Chang-yong issued a cautionary message in a press briefing that the home price issue could influence the pace of rate cuts. He said, "The pace of housing price increases in the Seoul Capital Area is faster than last August," adding, "At the time, after pausing a rate cut once, we thought the issue (of home prices) was contained, but now I’m not sure we’ll see a ‘happy ending’ anytime soon."

Home prices are rising faster than last year

As referenced by Governor Lee, the BOK held its key rate steady at 3.50% per annum in August last year. Although concerns over low growth had risen, supporting the case for a rate cut from an economic standpoint, the decision weighed more heavily on the surge in household debt. At that time, there were comments from the Presidential Office expressing regret, and some criticized Governor Lee for missing the right timing for a rate cut.

During the meeting, he emphasized that worries are even greater now than last August, considering the current pace of house price increases in the Seoul Capital Area. Although the BOK lowered the rate at the next committee meeting (October last year), this time, it is expected that the rate cut timing could be pushed back even further. Regarding the real estate measures announced by the government last month (June 27 Real Estate Measures), he said, "I highly praise the announcement of bold policies," but also remarked, "If housing prices remain uncontrolled, additional measures may be needed."

As for household debt, he predicted its growth would slow after a lag of about two months. Governor Lee explained, "After the real estate measures were announced, the volume of home transactions decreased," and "for about two months, household debt will continue to grow due to earlier increases in transactions, but if the decrease in volume persists, household debt is expected to decline again afterward."

Governor Lee also stated that, for household debt management, the BOK should secure co-investigation powers in the non-banking sector if the financial authorities undergo organizational restructuring. He pointed out, "The reason household debt has not decreased for over 20 years and the real estate project financing problems arose is that macroprudential policies have not been firmly enforced in practice," adding, "Macroeconomic and monetary policies need to operate organically, but such a mechanism did not exist."

U.S. tariffs are also a variable

Governor Lee also cited the level of tariffs imposed by the Donald Trump U.S. administration as another important variable in determining whether there will be a rate cut in August. If the 25% reciprocal tariff announced by the United States is imposed starting the first of next month, growth forecasts may decline sharply, and despite concerns over financial stability, a rate cut may be necessary.

He remarked, "Depending on how the United States handles tariffs, there is a strong possibility that growth forecasts could drop significantly," and "not only tariffs imposed on Korea but also tariffs on countries where Korean companies have production plants are important." He further explained, "When prices are stable, it is difficult to say that either growth or financial stability has priority," and "if tariffs rise sharply and real estate prices remain uncontrolled, differences of opinion among committee members could become significant."

Market sees policy as dovish

In the market, the Monetary Policy Committee’s results and Governor Lee’s briefing were assessed as having dovish (accommodative) elements. While there were strong messages of caution regarding household debt and home prices, many market participants also saw it as a signal that rates could be cut as soon as home prices become stable. The fact that four committee members mentioned the possibility of a rate cut within three months likewise influenced such assessments. One market participant commented, "I thought the number of rate cut supporters would decrease within three months, but the figure remained the same as in the May meeting."

On this day, yields on government bonds fell across the board in the Seoul Bond Market. The three-year government bond yield closed at 2.433% per annum, down by 0.045 percentage points. The yields for five- and ten-year government bonds each fell by 0.044 percentage points and 0.040 percentage points, respectively.

Kang Jin-kyu, reporter, josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)