Last year, won-denominated settlement in Korea’s imports and exports neared ₩80 trillion

Summary

- It was reported that last year, the scale of won-denominated settlements in Korea’s trade transactions reached ₩80 trillion.

- Concerns have been raised that if the usage of dollar stablecoins becomes mainstream, the demand for won settlements maintained in trade transactions could be eroded.

- The industry emphasized the urgent need to introduce a won stablecoin to prevent won-denominated trade settlements from being replaced by dollar coins.

Won ranked 2nd in import settlements from the EU

"If dollar stablecoins become mainstream, even the remaining won settlement demand will be eroded"

Last year, the scale of won-denominated settlements in Korea’s trade transactions reached ₩80 trillion. There are concerns that if the use of dollar stablecoins becomes mainstream, even the remaining demand for won settlements in trade transactions could be eroded.

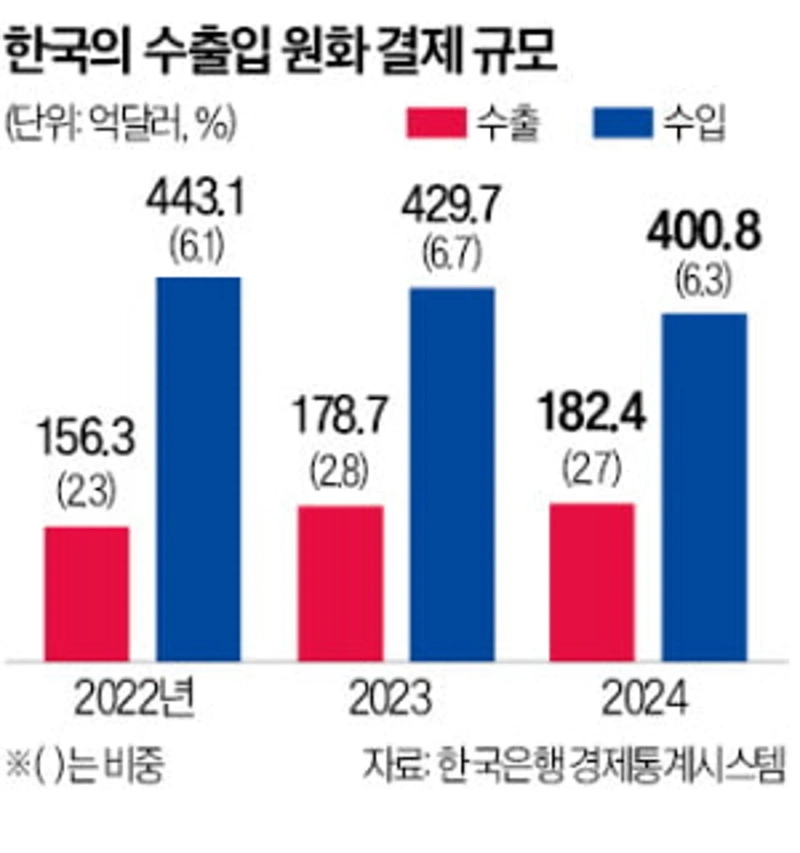

According to the Bank of Korea on the 14th, the size of won settlements in last year’s export and import (based on customs clearance) transactions was tallied at $58.32 billion, which is close to ₩80 trillion when converted to won. Of this, the amount of won-denominated settlements in exports was $18.24 billion, accounting for 2.7% of the total. In export transactions, the share of settlements in US dollars (84.5%) and euros (6%) exceeded 90%. The proportion of won settlements was higher than Japanese yen (2%) or Chinese yuan (1.5%).

Won settlements were more active in imports. The amount of won settlements in imports was $40.08 billion, accounting for 6.3% of the total. This was the second largest share after US dollars (80.3%). In imports from the European Union, the proportion of won settlements was 27.3%, overtaking the US dollar (25.1%), and coming in second after the euro (45.8%). It is reported that domestic automobile import dealers have a high demand for won settlements.

There are worries that if dollar-based stablecoins secure legal status in the United States and dominate the digital payment market, demand for won settlements in trade transactions will be eroded. Companies that use the won in export and import transactions do so not because they prefer the currency, but as a realistic choice to reduce currency exchange costs and exchange rate risk. Minseop Yoon, Director at the Digital Consumer Research Institute, said, "If a trading partner wants to transact in stablecoins, Korean companies will have no choice but to comply."

If dollar stablecoins are used more extensively in trade transactions, the number of foreign exchange transactions that the government cannot track may gradually increase. Currently, most foreign exchange transactions can be tracked through banks and other financial institutions, so statistics can be confirmed. However, if money moves in a decentralized manner, like with stablecoins, the Bank of Korea or the government may find it difficult to conduct macroeconomic policy, such as managing exchange rate stability, foreign reserves, or capital flows. An industry insider commented, "To prevent won trade settlements from being overtaken by dollar coins, the adoption of a won stablecoin is urgently needed."

Mihyun Cho mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)