Summary

- While Bitcoin (BTC) reached an all-time high, the Miners' Position Index surged to a level similar to previous major sell-offs.

- Approximately 6,000 Bitcoins from miners were deposited into Binance exchange between the 12th and 14th, possibly leading to selling pressure.

- The contributor mentioned the possibility of short-term selling pressure, but added that if investor demand stays strong, a long-term uptrend could be maintained.

Bitcoin (BTC) has reached an all-time high, with selling activity observed among miners.

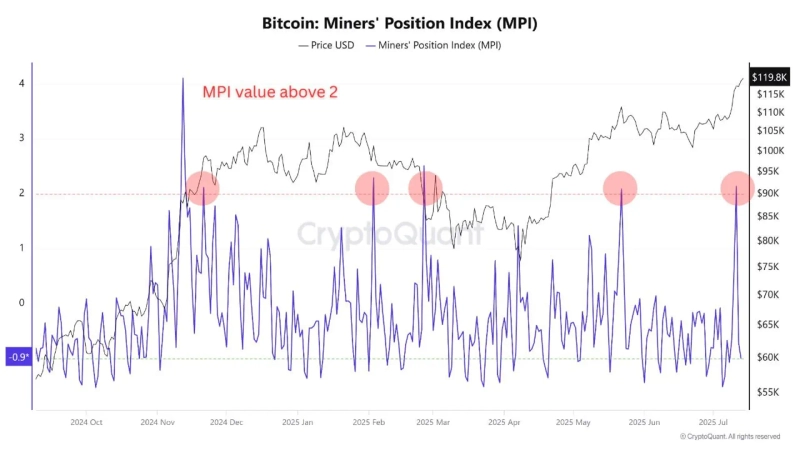

On the 15th (Korean time), CryptoQuant contributor Amr Taha reported, "The Miners' Position Index (MPI) has surged to levels similar to previous major sell-offs." The Miners' Position Index is a ratio comparing the amount of Bitcoin miners send to exchanges with the one-year average. Typically, when the MPI is above 2, it often signals large-scale Bitcoin selling by miners.

The contributor noted, "Between the 12th and 14th, about 6,000 Bitcoins from miners were deposited into Binance," and explained, "This coincided with the time when Bitcoin was approaching $120,000, likely due to arbitrage, derivatives hedging, or preparation for large transactions."

However, the contributor added, "There may be short-term selling pressure," but also stated, "If demand from other investors remains strong, the long-term uptrend could be sustained."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)