Summary

- Existing financial systems are showing limitations in transaction efficiency for AI-to-AI commerce.

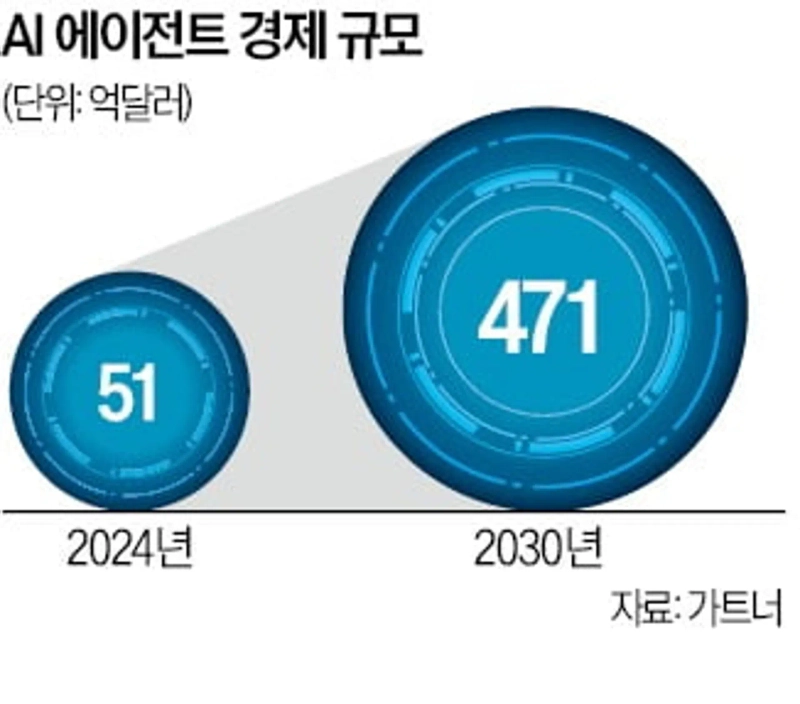

- The global AI agent market is projected to grow more than ninefold by 2030, with the use of stablecoins expected to rise accordingly.

- Experiments with stablecoin-based AI payment systems are underway in the U.S., attracting attention as a core payment method for AI transactions.

Spotlight as the AI Agent Market Grows

Traditional Finance Struggles to Keep Up

Overseas Experiments with AI-based Crypto Payments

As the era where artificial intelligence (AI) entities buy and sell data and services among themselves approaches reality, there are forecasts that stablecoins—cryptocurrencies pegged to the value of fiat currencies like the US dollar—will emerge as the main payment method in AI-to-AI commerce. This is mainly because the traditional financial system cannot keep up with transactions between AIs. Overseas, payment tests are underway to enable real-time usage fee payments by AIs.

According to market research firm Gartner, the global AI agent market was worth $5.1 billion last year. AI agents refer to software programs that use AI to understand objectives like humans and independently make decisions to perform tasks. This market is projected to grow more than ninefold to $47.1 billion by 2030.

As the AI agent market is expected to expand, the use of stablecoins is anticipated to increase as well. AI agents will routinely exchange information with other AI services or purchase data, repeatedly carrying out a series of such transactions. The main challenge is the payment infrastructure.

Since AI reacts in real time and works around the clock, the existing payment systems can hardly keep up with this. Traditional financial networks are hampered by banking hours, intermediary institutions, foreign exchange fees, and resulting transaction delays and additional costs. Many experts therefore believe that these conventional payment systems are ill-suited to handle the countless microtransactions between AIs.

Stablecoins, operating on blockchain platforms, can handle thousands of transactions per second without fees. Transaction fees are minimal, and global payments can be made without intermediaries. This is why stablecoins are considered a viable alternative for AI-to-AI transaction structures, where real-time settlement and automation are key. Because their value is pegged to fiat currencies, stablecoins maintain price stability, unlike Bitcoin and other cryptocurrencies.

Experiments combining stablecoin payment systems with AI agents are already underway overseas. One prominent example is the 'x402 Protocol', currently being developed by U.S.-based cryptocurrency exchange Coinbase. The x402 protocol is an autonomous payment system designed to support real-time commerce between AIs. It is engineered so AI agents can complete payments without human intervention.

Reporter Mihyun Cho, mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)