Summary

- It has been reported that Bitcoin (BTC) spot ETFs have seen net capital inflows for nine consecutive trading days.

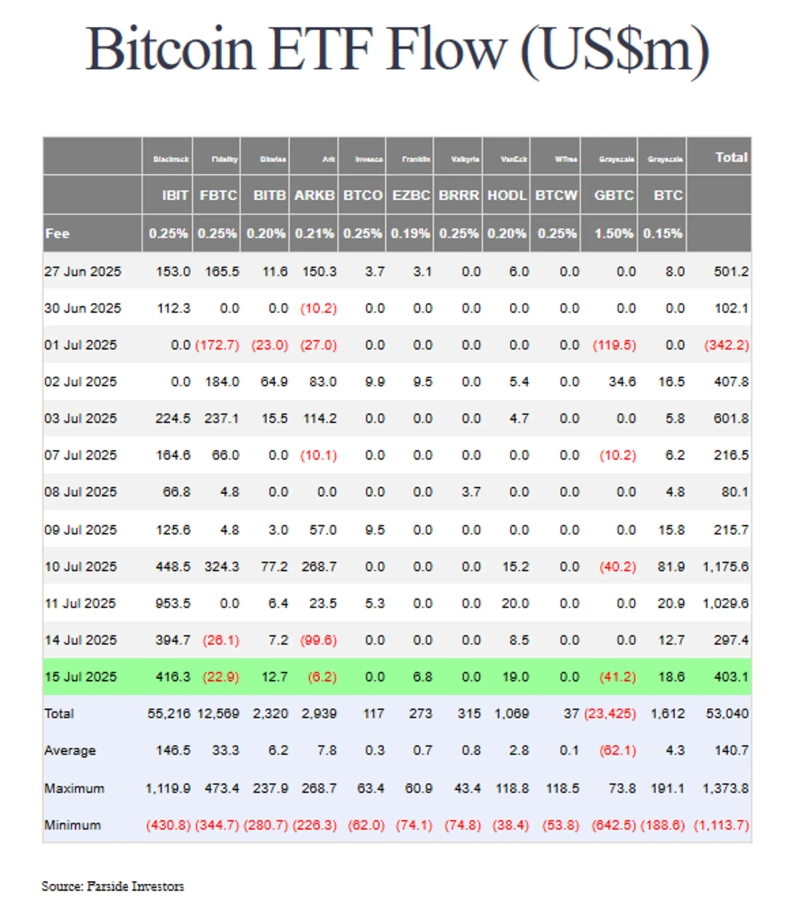

- On the 15th, a net inflow of $430 million was recorded, with BlackRock’s IBIT receiving the highest amount at $416.3 million.

- Fidelity’s FBTC and Grayscale’s GBTC saw outflows of $22.9 million and $41.2 million respectively.

There has been a net capital inflow into Bitcoin (BTC) spot Exchange-Traded Fund (ETF) products for nine consecutive trading days.

According to data from Farside Investors on the 16th (local time), there was a net capital inflow of $430 million into Bitcoin spot ETFs on the 15th. The product with the largest capital inflow was BlackRock’s IBIT, receiving $416.3 million.

On the other hand, Fidelity’s FBTC saw an outflow of $22.9 million, and Grayscale’s GBTC experienced an outflow of $41.2 million.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)