Integration of AI Technology into Local Currency... Promoting Stablecoin Development

Summary

- BNK Financial Group announced that it will actively promote the integration of AI technology into local currency and the development of stablecoins.

- They stated that accelerating the digital transformation of organizational structures and work processes, with a core strategy focused on advancing AI and digital finance.

- They are also focusing on securing future growth engines by supporting cooperation with fintech startups and digital transformation of SMEs.

BNK Financial Group Digital Innovation

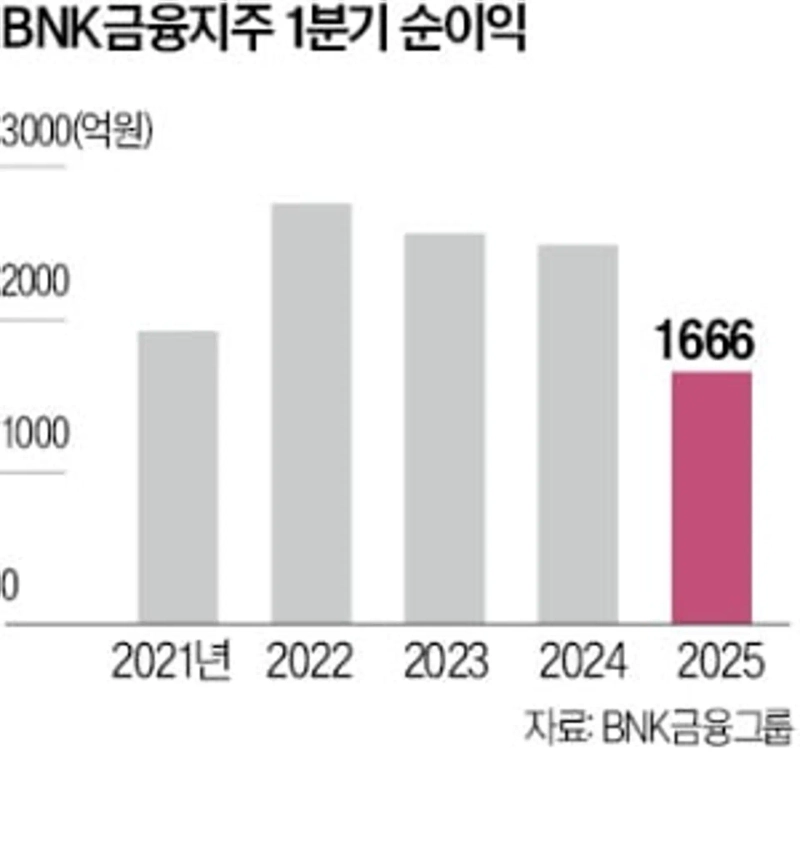

BNK Financial Group is concentrating its capabilities on digital transformation to overcome the limitations as a regional financial holding company. The company has determined that 'digital' is the breakthrough for regional financial companies, which are at a significant disadvantage in population and industrial base compared to the Seoul metropolitan area, to survive and grow. Daeein Bin, Chairman of BNK Financial, established a digital finance think tank directly under the chairman and is accelerating the transition to a digital-centered system by strengthening collaborations with regional startups.

At the '2025 Second Half Business Report Meeting' held on the 7th, BNK Financial selected 'AI and digital finance advancement' as one of the three major strategies for the second half of this year. To this end, an 'AI governance' system will be established to systematically enhance AI-based digital financial capabilities. Experiments with future-oriented financial models are also set to begin in earnest, including the development of local currencies infused with digital technologies and research on KRW-based stablecoins.

The organizational structure is also being fully revamped around digitalization. Last year, BNK Financial launched the Digital Sales Center, IT Planning Division, and Non-face-to-face Customer Department, and in April brought in external digital experts including Seongpyo Jeon, Head of Customer Experience (CX) Innovation. The group’s goal is to enable most financial operations to be handled easily via mobile. For instance, the verification process for account transfers below ₩1,000,000 has been streamlined from three steps to just one, improving customer convenience.

Immediately after his appointment in 2023, Chairman Bin established the 'Digital Innovation Committee' directly under his office, presenting digital transformation as a core task for the group. This committee plays a key role in establishing the group's digital vision, setting strategic directions, and exploring new future business opportunities. Since April, external consulting has been used to flesh out BNK Financial’s digital blueprint and business strategies, with a long-term goal of transforming BNK Financial into a comprehensive digital financial platform.

BNK Financial is also promoting projects to integrate advanced technologies such as AI, big data, and deep learning into the management activities of local SMEs. The aim is to improve customer companies’ operational efficiency, productivity, and customer experience. In May, the group signed a 'business agreement for building a digitally-based corporate ecosystem' with Busan Economic Promotion Agency and KoDATA, launching efforts to develop tailored platforms for SMEs and automate administration using AI.

A BNK Financial official stated, "Digital transformation is essential for local SMEs to increase operational speed, reduce costs, and discover new business opportunities, but many companies face challenges in adoption due to lack of infrastructure, difficulties in securing professional personnel, and initial investment burdens."

Support for local startups is also in full swing. Since 2019, BNK Financial has been running a startup accelerator program called 'Some Incubator.' Now in its 10th cohort, this program provides office space, funding, and mentoring to prospective entrepreneurs and early-stage startups, supporting their market entry and building a foundation for global expansion.

Following Chairman Bin's inauguration, a fintech-specialized incubation platform project called 'Storage B' is also underway. Through collaboration with fintech startups with technological competitiveness in payments, data, and AI solutions, the group is seeking future growth engines. On the 10th of this month, a personal credit loan product jointly planned by Busan Bank and K Bank was designated as an innovative financial service by the Financial Services Commission, marking a meaningful achievement in the group's digital finance expansion efforts.

Hyeonggyo Seo, Reporter seogyo@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)