Editor's PiCK

"Fed Independence Violation... Could Lead to Adverse Effects"

Summary

- JP Morgan's Jamie Dimon warned that infringement of the Fed's independence could have negative adverse effects on the market.

- He stated that if Chairman Powell is dismissed, Treasury yields could surge, eliminating President Trump's interest rate cut effect.

- American financial firm Piper Sandler projected that the U.S. 10-year Treasury yield could rise by 0.25~0.5% points if Chairman Powell is dismissed.

Dimon, Chairman of JP Morgan

Criticizes Trump's Pressure

'Emperor of Wall Street' Jamie Dimon, chairman of JP Morgan, sharply criticized President Donald Trump's push to dismiss Jerome Powell, the chairman of the Fed, stating, "The independence of the Fed is absolutely crucial."

At a press conference after announcing second quarter results on the 15th (local time), Dimon warned, "Messing with the Fed can often result in adverse effects, with outcomes that can be completely opposite to what was expected." U.S. media reported that as President Trump, who is in conflict with Chairman Powell over interest rate cuts, suggested the early dismissal of Powell, Dimon spoke out on behalf of all of Wall Street with a firmly determined statement.

The Wall Street Journal (WSJ) noted, "Dimon was the first chief executive among major U.S. financial institutions to make a public stance on criticism from the U.S. administration toward the Fed chairman," adding, "He is known to speak his mind boldly and without reservation." The report continued, "After President Trump announced reciprocal tariffs in April, during a Fox Business interview, Dimon publicly warned that a recession could come to the U.S., and there are accounts that President Trump, who was watching the interview, actually adjusted his policies."

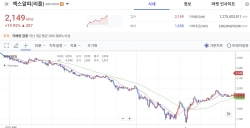

In the market, there is a view that it will be difficult for President Trump to actually dismiss Chairman Powell early. This is because if Powell is dismissed, Treasury yields could surge, negating the desired effect of interest rate cuts sought by President Trump.

According to WSJ, American financial company Piper Sandler projected that in the event of Powell's dismissal, the 10-year U.S. Treasury yield could instantly jump by 0.25~0.5% points. On the 8th of this month, President Trump told reporters, "There are no plans to dismiss Chairman Powell."

Economic journalist Han Kyung-jae hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)