Editor's PiCK

Amid U.S. Inflation Concerns, More Tariff News Emerges… Global Stock Markets Weaken

Summary

- Global stock markets weakened amid news of U.S. tariffs and a rise in the June Consumer Price Index (CPI).

- President Trump announced tariff plans on pharmaceuticals and semiconductors, heightening investor uncertainty.

- Lowered expectations for U.S. rate cuts have strengthened the dollar, while some assets like Bitcoin and Ether have risen.

U.S. stock futures decline, Asian markets also experience overall drops

Trump mentions tariffs on semiconductors and pharmaceuticals and discusses opening the Korean market

Rate market lowers probability of U.S. rate cuts in September

Negative news surrounding tariffs continues to emerge, June's Consumer Price Index (CPI) surged as expected, and diminishing hopes for rate cuts led U.S. stock futures to decline on the 16th (local time). Asian and European stock markets also turned bearish.

U.S. President Trump stated the previous day that tariffs on pharmaceuticals could be imposed starting at the end of this month, with similar measures potentially following for semiconductors. He announced that the pharmaceutical tariffs would initially be set at low levels, granting about a year for market entry into the U.S., after which higher tariffs would be imposed. Regarding semiconductor tariffs, he said they were "similar to those on pharmaceuticals but less complicated." He added negotiation pressure on South Korea by commenting, "Japan will not agree to market opening, but South Korea is leaning towards it."

President Trump stated that pharmaceutical tariffs would "likely take effect at the end of this month," and that he would "start with low tariffs to give pharmaceutical companies about a year to build factories in the U.S., followed by very high tariffs." He noted that the timing of tariffs on semiconductors would be similar to that of pharmaceuticals but less complex.

On this day, S&P 500 index futures fell for the second consecutive day, dropping by 0.2%. Nasdaq futures, which had risen the previous day, also slid by 0.3%.

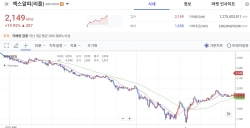

In Asian markets, the Hong Kong Hang Seng Index dropped by 0.25%, the Shanghai CSI by 0.03%, the Nikkei 225 by 0.04%, and South Korea's KOSPI by 0.9%. Japan's super-long-term government bonds, which had plummeted early in the week on fiscal spending concerns following this weekend's House of Councillors election (= soaring bond yields), rebounded afterwards. Taiwan's stock market rose by 0.9% fueled by the strong performance of Nvidia.

The European Stoxx 600 index fell by 0.2% as technology stocks declined following ASML, a leading lithography equipment manufacturer, lowering its outlook for next year due to trade tensions.

Rate traders now assign lower odds to a September rate cut, as June’s CPI reached a five-month high, indicating more pronounced tariff effects and likely larger future inflation impacts. According to CME Group's FedWatch tool, rate swap traders anticipated about a 60% chance of a September rate cut before the CPI release, but this has dropped to 50% now. U.S. Treasuries, which saw yields rise after the CPI release the previous day, remained steady.

Bitcoin, which had fallen due to profit-taking the previous day, rose by 1.6% to $118,260.42. Ether climbed 4.1% to $3,165.32.

As of 06:44 a.m. London time, the spot gold price was $3,339.88 per ounce, up 0.5%. U.S. gold futures increased 0.3% to $3,346.70.

Junga Kim, Contributing Reporter kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)