Summary

- It was reported that the yield on 30-year U.S. Treasuries has once again exceeded 5% per annum after about a month.

- It was stated that a large influx of funds in options trading is betting on the 30-year yield rising to 5.3%.

- Due to the rise in Treasury yields, bond prices dropped and investors' net long positions shrank to their smallest in six months.

CPI increase intensifies selling pressure

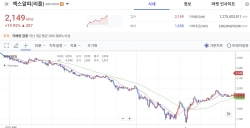

The yield on the 30-year U.S. Treasury has once again surpassed 5% per annum after about a month.

According to Bloomberg on the 15th (local time), the yield on the 30-year U.S. Treasury rose as high as 5.023% intraday. This is the first time since early last month that the 30-year yield has exceeded 5%. Bloomberg reported, "A significant influx of funds paid a premium of about $10 million in options trading targeting a rise in the 30-year yield to 5.3% within about five weeks," adding, "A 30-year yield at around 5.3% would be the first since 2007." Financial media Barron's reported, "In the past 15 years, the 30-year yield climbed above 5% only 15 times, including this time."

As a result, bond prices fell. According to a survey by JPMorgan Chase conducted among bond investors, their net long positions shrank to the smallest level in six months. On this day, the U.S. June Consumer Price Index (CPI) was announced to have risen 2.7% year-on-year. The growth rate increased from May’s 2.4%, further intensifying the selling pressure on U.S. Treasuries.

Bloomberg pointed out, "With concerns over tariff-induced inflation and widening fiscal deficits, a bearish tone is dominating the Treasury market."

By Dong-hyun Kim 3code@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)