Summary

- The UK's Consumer Price Index (CPI) for June rose more than expected, reaching 3.6%.

- As a result, investors noted that the likelihood of a Bank of England rate cut has decreased.

- This news saw Pound Sterling break an eight-day decline, and the 10-year government bond yield also increased.

Impact of payroll tax and minimum wage increases effective in April

The UK’s inflation rate soared to 3.6% in June, the highest since January 2024.

On the 16th (local time), the Office for National Statistics (ONS) announced that the Consumer Price Index (CPI) rose from 3.4% in the previous month to 3.6% in June. This exceeded the 3.4% expected by economists.

Food prices jumped 4.4%, the highest since February 2024. The service sector’s inflation rate also surpassed expectations, reaching 4.7%. This index is closely watched by the Bank of England as a key indicator for domestic recession concerns.

Retailers pointed to the payroll tax and minimum wage increases that took effect in April as causes. Ruth Gregory, an economist at Capital Economics, said, “Stronger-than-expected hotel inflation and rises in clothing and footwear prices may signal that businesses are passing on higher employment costs.”

Kris Hamer, Insight Director of the British Retail Consortium, stated, “Despite fierce competition among retailers, the sustained impact of the last budget and plunging harvests due to extreme weather conditions have caused consumer prices—especially for food—to rise.”

The ONS explained, “The inflation rate was further pushed up because automotive fuel prices, which had fallen sharply during the same period last year, declined only slightly this year.”

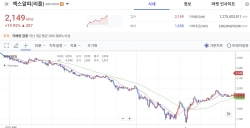

Pound Sterling rose 0.1% to $1.34, ending an eight-day losing streak. The yield on the UK 10-year government bond climbed by 4 basis points (1bp=0.01%) to 4.66%. Investors scaled back their bets on a Bank of England rate cut.

Junga Kim, contributing reporter kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)