Editor's PiCK

"Impending Powell Dismissal" Report Sends Markets Into Panic... Trump Backtracks [Fed Watch]

Summary

- Reports of Jerome Powell’s potential dismissal have caused instability in the market, with bond prices plunging and Treasury yields surpassing 5%.

- The market calmed somewhat after President Trump denied the dismissal rumors, making reassuring comments.

- The article warns that the ongoing controversy over the Fed’s independence could undermine market confidence in the U.S. government.

Private Discussions with Republican Lawmakers

Leak Causes 'Financial Instability'

Trump Quells Rumors: "No Plans to Sack Powell"

President Donald Trump has backed down. Trump, who had been strongly insisting that Fed Chair Jerome Powell should soon step down, was asked today about reports of Powell’s imminent dismissal and replied, "It’s unlikely." This uncharacteristic response appeared to stem from concerns over the market’s sensitive reaction.

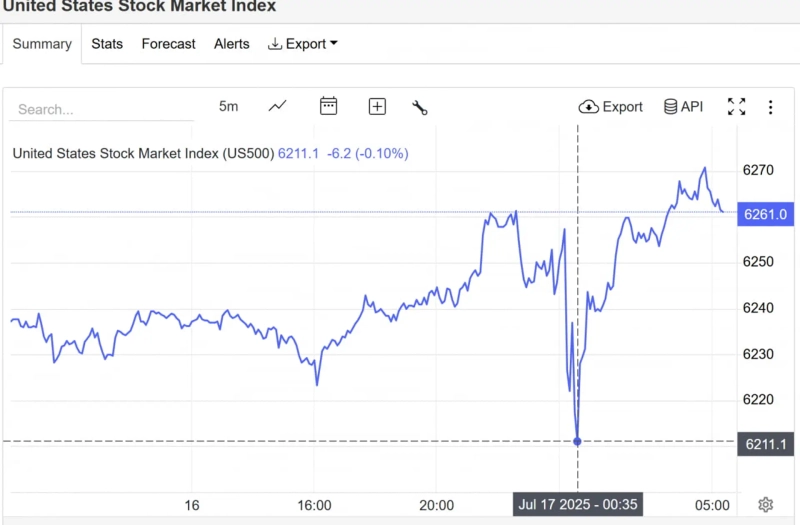

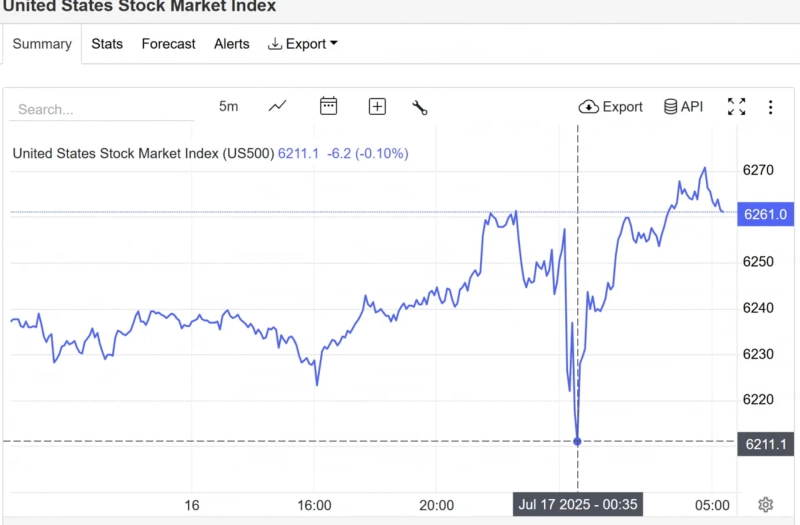

Earlier, reports that Powell’s dismissal was imminent sent the bond market tumbling. The yield on 30-year U.S. Treasury bonds hit 5.04% around noon EST, an increase of 2bp from the previous day. While the absolute rise wasn’t huge, surpassing the 5% psychological threshold carried symbolic weight. At around 10:45 a.m., yields were at 4.97% before leaping to 5.04%, a 7bp increase.

The market’s turmoil was triggered by the leak of a private meeting between Trump and Republican lawmakers the day before. At the meeting, Trump reportedly asked for opinions on firing Powell, and lawmakers were generally supportive. In particular, Florida Representative Anna Paulina Luna posted on social media platform X that she had heard from a "very reliable source" that Powell was being dismissed, stating, "99% confident, the dismissal is imminent."

However, once the market reacted sharply, Trump backed off. When asked by reporters today, he said, "I never rule anything out," but also added "Unless he steps down for fraud, I think the chances of a dismissal are very low." When asked again whether he planned to dismiss Powell, Trump replied, "I have no such plan." After these statements, market panic somewhat subsided.

The 30-year Treasury yield has since come down to around 5.01%. The S&P 500 index, which had dropped to the low 6200s, recovered to the 6260 range following Trump’s remarks and closed up 0.3%. The Dow Jones Industrial Average also rose 0.5% to finish the session. The dollar, which at one point dropped to around 97.8, rebounded to 98.2.

Trump’s reference to ‘fraud’ relates to the fact that the president does not have the authority to dismiss the Fed Chair outright. Unless there are special circumstances such as misconduct, the Fed Chair does not have to step down. But in very rare cases like fraud, dismissal could theoretically be possible. Currently, the Trump administration claims to have spent $2.5 billion, or about ₩3.5 trillion, renovating the Fed building—$700 million over the original plan. The administration reportedly considered using this issue to justify firing Powell. However, Powell has stated that the additional spending was justified and that reports are exaggerated.

Even having the independence of the Fed questioned is never good for the U.S. government. If the markets do not trust the government—even if it tries to lower interest rates—bond prices fall and yields rise. If inflation is stoked by artificially lowering rates, public discontent also grows. Although warnings have come from Wall Street, it remains uncertain whether Trump will change his mind.

Washington, D.C.—Sang-Eun Lee, correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)