Editor's PiCK

[New York Stock Market Briefing] Volatility increases on rumors of Powell's dismissal... Expectations for rate cuts also rise

Summary

- The New York stock market reported that volatility increased on rumors of Federal Reserve Chairman Powell's dismissal, but stocks turned higher and closed with gains after Powell's dismissal was denied.

- June U.S. Producer Price Index (PPI) came in below expectations, prompting hopes for rate cuts and bargain buying.

- With expectations for rate cuts rising, some large technology and pharmaceutical stocks showed notable increases.

Major indexes were volatile on the New York Stock Exchange. When U.S. President Donald Trump was rumored to be considering the dismissal of Federal Reserve (Fed) Chairman Jerome Powell, the market fell, but after President Trump denied the speculation, stocks rebounded and closed higher.

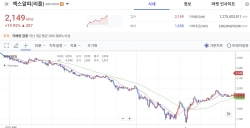

On the 16th (local time) at the New York Stock Exchange (NYSE), near the close, the Dow Jones Industrial Average was up 231.49 points (0.53%) to 44,254.78, the S&P 500 Index rose 19.94 points (0.32%) to 6,263.70, and the NASDAQ Composite Index finished up 52.69 points (0.25%) at 20,730.49.

Early in the session, indexes gained after the U.S. Department of Labor's release of the June Producer Price Index (PPI) came in below expectations. While the previous day's Consumer Price Index (CPI) showed the effects of U.S. tariff policy, causing some correction in the market, the weaker PPI calmed nerves and triggered bargain buying. The June PPI in the U.S. was flat from the previous month on a seasonally adjusted basis. Market expectations were for a 0.2% increase. However, the May PPI was revised higher from a 0.1% to a 0.3% increase.

However, when multiple media outlets reported that President Trump might fire Chairman Powell, the market dropped sharply. Immediately after, President Trump told reporters at the White House, "Unless Chairman Powell's (regarding the Fed headquarters renovation) morale issues come to light, it is very unlikely he will be dismissed." Some in the market speculate that President Trump used the media to test the market’s reaction in advance were he to dismiss Chairman Powell.

In some corners of the market, there is a growing expectation for a Fed rate cut based on President Trump's pressure on Powell. According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the federal funds futures market is pricing a 22.4% probability of a 75bp rate cut by December. As of the previous day's close, the probability was 19.1%.

Among major tech stocks, Tesla stood out with a 3.5% gain after announcing plans to launch a six-seater Model Y in China. NVIDIA and Apple each rose 0.39% and 0.5%, respectively. Alphabet, Google’s parent company, also gained 0.37%.

On the other hand, Amazon and Meta Platforms fell by 1.4% and 1.05%, respectively.

Pharmaceutical giant Johnson & Johnson surged more than 6% after reporting strong Q2 results and raising its annual guidance. This improved investor sentiment for the pharmaceutical sector, leading Eli Lilly to rise 2.34% as well.

Major U.S. commercial and investment banks, including Morgan Stanley, Goldman Sachs, and Bank of America, also reported solid results. However, share prices saw Morgan Stanley and Bank of America fall 1.27% and 0.26%, respectively, while Goldman Sachs rose 0.9%.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) decreased by 0.22 points (1.27%) to 17.16.

Han Kyung-woo, Hankyung.com reporter case@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)