Editor's PiCK

[New York Stock Market Briefing] 'Retail Sales' Ease Tariff Concerns... S&P and NASDAQ Hit All-Time Highs

Summary

- The U.S. retail sales indicator significantly exceeded market expectations, with the New York market's S&P 500 Index and NASDAQ Index reaching all-time highs.

- Major companies such as United Airlines, PepsiCo, and Netflix announced strong earnings, resulting in sharp increases in their stock prices.

- Technology companies with a market capitalization over $1 trillion like NVIDIA, Microsoft, and Broadcom showed strong performance, and Lucid Group's stock price surged by 36% on news of collaboration with Uber.

The three major U.S. stock indices in the New York market rose together. Market sentiment appears to have been relieved as generally strong earnings from U.S. companies coincided with a robust rebound in consumer indicators.

On the 17th (local time) at the New York Stock Exchange (NYSE), the Dow Jones Industrial Average closed up 229.71 points (0.52%) at 44,484.49. The S&P 500 Index rose by 33.66 points (0.54%) to 6,297.36, and the NASDAQ Composite Index climbed 153.78 points (0.73%) to finish at 20,884.27.

On this day, both the S&P 500 Index and NASDAQ Index set new all-time highs for the second consecutive day. Stronger-than-expected U.S. consumer data and corporate second-quarter earnings boosted the stock indices.

According to the United States Department of Commerce, U.S. retail sales in June, seasonally adjusted, increased by 0.6% from the previous month to $720.1 billion. Market expectations had been for a 0.1% increase. Previously, retail sales in May had plummeted by 0.9% from the prior month.

In particular, 'core retail sales' (control group) excluding the highly volatile categories of automobiles, gasoline, building materials, and food services also rose by 0.5% from the previous month.

Companies also reported strong results.

United Airlines posted better-than-expected earnings, sending its stock price up 3%. PepsiCo also announced second-quarter earnings that exceeded expectations, causing its stock price to soar 7%.

Netflix also announced second-quarter results surpassing forecasts. After the close of trading, Netflix reported Q2 revenue of $11.08 billion and earnings per share (EPS) of $7.19. Both slightly beat market expectations.

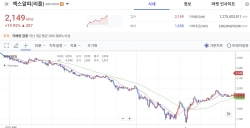

Among major technology companies with a market capitalization exceeding $1 trillion, NVIDIA, Microsoft, and Broadcom all showed strong gains and set new all-time highs. NVIDIA's market cap reached $4,221.2 billion.

U.S. artificial intelligence (AI) defense company Palantir also rose 2%, hitting an all-time high.

Electric vehicle maker Lucid Group surged 36%, boosted by news that at least 20,000 Lucid vehicles would operate as robotaxis on Uber's ride-sharing platform over the next six years, spurring investor interest.

Min-kyung Shin, Hankyung.com journalist radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)