Editor's PiCK

US Bitcoin Spot ETF Sees $363.5 Million Net Inflow the Previous Day…12 Consecutive Trading Days

Summary

- The US Bitcoin spot ETF reportedly recorded net inflows for 12 consecutive trading days.

- While BlackRock's IBIT led the inflows with a net $496.8 million, Grayscale's GBTC and other products reportedly saw net capital outflows.

- With inflows and outflows varying by ETF, it is suggested that investors’ product preferences are becoming apparent.

The US Bitcoin (BTC) spot ETF has continued to see net inflows for nearly two weeks.

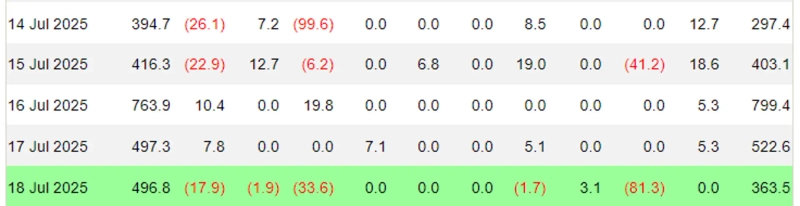

According to Farside Investors on the 19th (local time), the previous day, US Bitcoin spot ETFs recorded a net inflow of $363.5 million (approximately ₩506.5 billion). This marks 12 consecutive trading days of net inflows.

On this day, BlackRock's IBIT led the fund inflow, posting an overwhelming net inflow of $496.8 million. In addition, WisdomTree's BTCW saw a net inflow of $3.1 million.

On the other hand, some products such as Grayscale's GBTC and ARK Invest’s ARKB recorded net outflows of $81.3 million and $33.6 million, respectively, continuing to see capital leaving. Fidelity's FBTC also saw a net outflow of $17.9 million, Bitwise's BITB had $1.9 million, and VanEck's HODL recorded a net outflow of $1.7 million. There were no net inflows or outflows for the remaining products.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)