Editor's PiCK

U.S. Ethereum Spot ETFs See Net Inflow of $402.5 Million the Previous Day — Approximately ₩560.8 Billion

Suehyeon Lee

Summary

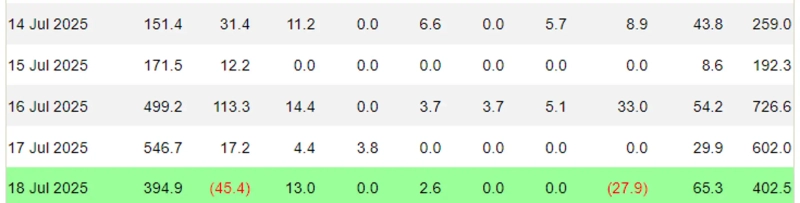

- U.S. Ethereum spot ETFs have recorded a net inflow of $402.5 million (about ₩560.8 billion) for 11 consecutive trading days.

- On this day, BlackRock ETHA reported the highest net inflow at $394.9 million, while Grayscale Mini ETH, Bitwise ETHW, and VanEck ETHV also saw inflows.

- Meanwhile, Fidelity FETH and Grayscale ETHE recorded net outflows of $45.4 million and $27.9 million, respectively.

U.S. Ethereum (ETH) spot ETFs saw a strong performance yesterday, recording a net inflow exceeding $400 million.

According to Farside Investors on the 19th (local time), U.S. Ethereum spot ETFs recorded a total net inflow of $402.5 million (approximately ₩560.8 billion) the previous day. This marks 11 consecutive trading days of net inflows.

On this day, BlackRock ETHA saw the largest net inflow at $394.9 million, followed by Grayscale Mini ETH with $65.3 million, Bitwise ETHW with $13 million, and VanEck ETHV with $2.6 million.

Meanwhile, Fidelity FETH and Grayscale ETHE recorded net outflows of $45.4 million and $27.9 million, respectively. There were no significant net inflows or outflows in other products.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)