Summary

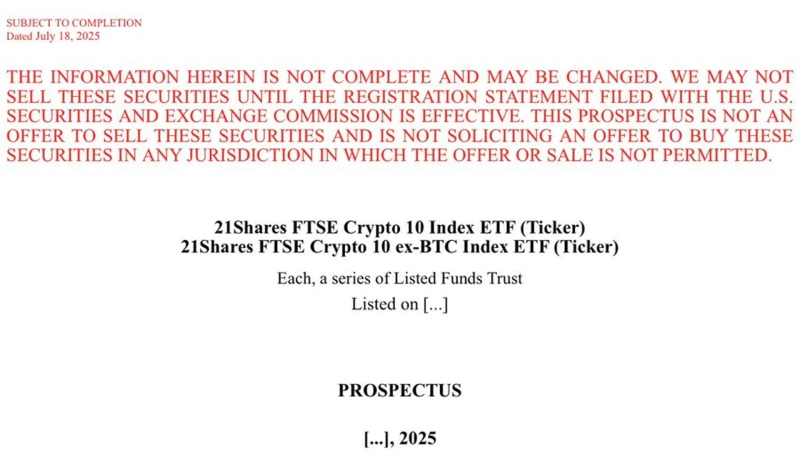

- 21Shares is reported to have newly filed two cryptocurrency index ETFs with the U.S. SEC.

- One of the filed ETFs will be composed of assets excluding Bitcoin, and both products will operate under the '40 Act' structure.

- While the SEC's cryptocurrency ETF regulatory framework is progressing slowly, ETF issuers are said to be independently expanding their market strategies.

It has been reported that 21Shares has newly filed for two cryptocurrency (virtual asset) index-based ETFs with the U.S. Securities and Exchange Commission (SEC).

On the 19th (local time), Nate Geraci, CEO of The ETF Store, stated, "21Shares has applied for two cryptocurrency index ETFs with the SEC, and one of them is expected to be composed of virtual assets excluding Bitcoin."

Both of the filed ETFs will be operated under a '40 Act' structure, similar to the recently launched Solana staking ETFs by REX Shares and Osprey. Regarding this, Geraci remarked, "While the SEC is still slow in establishing a regulatory framework for crypto ETFs, issuers are independently expanding their efforts to target the market."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)