U.S. Ethereum Spot ETF Sees Largest Weekly Net Inflow Since Launch This Week… 2.4x Increase from Previous Week

Summary

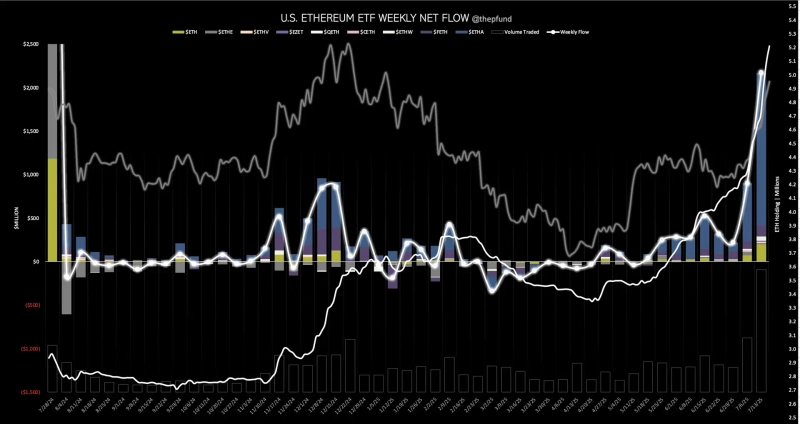

- The total net inflow for U.S. Ethereum (ETH) spot ETFs in week 28 increased 2.4 times from the previous week, setting the largest weekly net inflow since launch.

- This week's trading volume set a new all-time high at $11 billion, and BlackRock ETHA achieved a weekly net inflow of $1.754 billion, continuing nine consecutive weeks of capital inflow.

- Grayscale Mini ETH continued its 13-week streak of inflows and Fidelity FETH also recorded a weekly net inflow, showing consistent capital inflow.

The U.S. Ethereum (ETH) spot ETF recorded its largest weekly net inflow since its launch.

According to TraderT on the 19th (local time), the total net inflow for U.S. Ethereum spot ETFs in week 28 of trading reached $2.173 billion (approximately ₩3.028 trillion), a 2.4-fold increase in net inflow compared to the previous week. This marks the largest weekly inflow since their debut.

Trading volume this week also set a new all-time high at $11 billion. BlackRock ETHA posted a weekly net inflow of $1.754 billion, marking nine consecutive weeks of capital inflow. The cumulative inflow has surpassed $3.8 billion.

Grayscale Mini ETH saw an additional $202 million in inflows this week, sustaining 13 consecutive weeks of capital inflow, with its cumulative inflow totaling $459 million. Fidelity FETH also recorded a weekly net inflow of $129 million.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)