[Weekly Outlook] Relentless KOSPI, Will It Take a Breather… Wait-and-See Sentiment Spreads During Earnings Season

Summary

- This week, it is expected that the KOSPI will remain in a box range near 3200, showing a wait-and-see sentiment.

- The U.S.-driven mutual tariff negotiations and the Q2 major company earnings releases were identified as main variables for market volatility.

- Experts noted that a rotational market led by selective stocks is expected, focusing on tariff concerns and changes in earnings guidance.

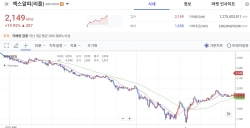

"This Week's KOSPI Expected Range: 3000~3250P"

Brokerages predict that the KOSPI will form a box range near the 3200 mark this week (21st–25th), showing a market taking a breather. This is due to the start of the Q2 earnings season among American financial firms and the possibility of closely watching mutual tariff negotiations between countries.

Jung-Hwan Na of NH Investment & Securities on the 20th presented this week’s expected KOSPI range as 3000~3250 points, analyzing, "Although there is ample idle capital in the stock market, expectations for a Fed rate cut have diminished, and the market is expected to keep an eye on U.S. mutual tariff negotiations."

On the last trading day of last week, the KOSPI closed at 3188.07 points, below 3200, as U.S. inflation concerns weighed on the stock market overall. Although there were no significant catalysts, upper levels edged higher on anticipation for new government policies, rising 0.38% compared to the previous week.

This week, investors will need to pay close attention to external factors. As the mutual tariff implementation deadline on the 1st of next month approaches, global stock markets may be affected by the outcome of tariff negotiations as much as by economic indicators. Previously, President Donald Trump announced that starting August 1st, Korea would be subject to a 25% mutual tariff.

Additionally, there are growing concerns in Washington that, even if Korea does exceptionally well in negotiations with the U.S., it will be difficult to avoid 'double-digit tariff rates,' further unsettling market participants.

Michael Beeman, former Deputy Director at the Office of the United States Trade Representative (USTR), stated on the 17th (local time) in a Korea Economic Institute of America (KEI) podcast, "If Korea reaches a successful agreement with the U.S., Korea’s average tariff is likely to be around 15~18%. This is simply the average tariff rate." Beeman was directly involved in trade negotiations with Korea during Trump’s first administration.

He added, "While some items such as autos and steel may see eased conditions, overall, tariffs would still be very significant."

Kyung-Min Lee, a researcher at Daishin Securities, pointed out, "Unless tariff negotiation results exceed investor expectations, pre-emptive optimism may fade amid strong remarks from President Trump."

The Q2 earnings season in the U.S. is also set to kick off in earnest. Starting with Verizon on the 21st, companies like General Motors, Coca-Cola, Texas Instruments (22nd), AT&T, IBM (23rd), and Intel (24th) will be announcing their results. In particular, market attention is focused on the results and guidance adjustments from Alphabet and Tesla on the 23rd.

In Korea, Samsung Biologics (23rd), SK Hynix, Hyundai Motor Company, KB Financial Group, HD Hyundai Heavy Industries, Samsung Heavy Industries, LG Household & Health Care (24th), Kia, LG Energy Solution, Doosan Enerbility, Shinhan Financial Group, and Hana Financial Group (25th) are all waiting to announce earnings.

Researcher Na explained, "If companies' guidances are revised downward, it could spotlight valuation concerns. We can also check in these results whether U.S. companies have passed tariff-related cost increases on to consumers."

Experts predict that, given the recent strong KOSPI uptrend, the domestic markets may display rotational trading focused on adjusting undervalued stocks.

Researcher Lee said, "It is expected to be more effective to focus on risk management and rotational strategies, instead of chasing strong sectors," adding, "Attention should be paid to previously overlooked sectors such as displays, secondary batteries, and healthcare."

Na also noted, "Despite tariff concerns, domestic stock market buying capital remains abundant," and added, "During earnings season, a sorting of winners and losers could occur, especially among stocks with significant price gains backed by solid results."

Jeong-Dong No, Hankyung.com reporter dong2@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)