"Giant Step for Dollar Hegemony"...Coin Market Cap Touches $4 Trillion for the First Time

Summary

- It was reported that the GENIUS Act passed in the United States has granted official legal status to stablecoins.

- As a result, the cryptocurrency market cap has surpassed $4 trillion for the first time in history, and institutional capital inflows are becoming active.

- The expansion of stablecoins is expected to be both an opportunity and a threat to global financial markets and Korean companies.

The Onslaught of Stablecoins

⑬ 'Dollar Coin' with Legal Status

Trump. Final Signature on GENIUS Act

"The Greatest Revolution Since the Internet"

Tether Market Cap Surpasses $161.6 Billion

Establishing a New Investment Base for U.S. Treasury Bonds

Keeping China in Check and Strengthening Dollar Status

Monetary and Macro Policy Variable for South Korea

"We have taken a giant step to solidify the dominance of the dollar in the global financial market." This is what U.S. President Donald Trump said on the 18th at the White House, right after signing the 'GENIUS Act'. The GENIUS Act is a law that officially recognizes, within the institutional system, stablecoins that are pegged 1:1 to the value of fiat currencies such as the dollar. With President Trump's final signature, stablecoins now have official legal status in the U.S. financial market. President Trump emphasized, "(The passage of this law) could be the greatest revolution in financial technology since the birth of the internet."

○Legal Status Secured

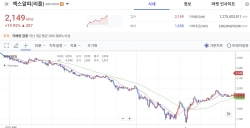

According to CoinMarketCap on the 20th, the total global cryptocurrency market capitalization briefly surpassed $4 trillion (₩5,574 trillion) for the first time ever. This is a direct result of the passage of the GENIUS Act and related virtual asset legislation in the United States. Tether's market cap also surpassed $161.6 billion, hitting a record high. Daily trading volume reached $180 billion. Mark Palmer, analyst at Benchmark Company, said, "Institutional funds that had been waiting for clarity are now flowing into the market."

Stablecoins are cryptocurrencies whose value is pegged to fiat currencies such as the dollar or euro, making them relatively stable. They are considered to offset the weaknesses of highly volatile coins like Bitcoin. However, stablecoins have so far mainly been used as a means of liquidity within the cryptocurrency market for coin trading.

The reason stablecoins had limited expansion into the real economy was that their legal status was unclear in most countries. This made it difficult for corporations or financial institutions to use them. They were also not connected to existing financial networks. In addition, there was a lack of trust in stablecoin issuers. For example, in the case of Tether, the world's top stablecoin issuer, controversies over transparency persisted regarding whether it held enough reserve assets to back its issued tokens.

The reason the GENIUS Act is expected to have a significant impact on the global financial market is that stablecoins have received official recognition as 'digital dollars'. In particular, by being incorporated into the institutional system in the world's largest financial market, the U.S., global businesses and financial institutions now have a legitimate rationale to adopt them as a legal payment method. According to the law, only bank subsidiaries or approved issuers may issue stablecoins. They must also hold 100% reserve assets matching the issuance volume. Furthermore, regular audits and mandatory disclosures are required.

○Means to Keep China in Check

The United States is openly positioning stablecoins as a key to strengthening the dollar's hegemony. The GENIUS Act requires stablecoin issuers to maintain reserves in U.S. dollars and Treasury bonds. With major countries such as Japan and China reducing their holdings of U.S. Treasury bonds, a new investment base for U.S. Treasuries has been formed. In reality, the volume of U.S. Treasuries held by major stablecoin issuers exceeds $180 billion, far surpassing South Korea's holdings ($125.8 billion).

President Trump indicated that stablecoins could also serve as a check against China's technological hegemony. On this day, President Trump mentioned stablecoins and AI together and said, "China is actually watching (cryptocurrencies) closely and likes it," adding, "We've made it (legislation) happen."

○Both Opportunity and Threat

With the expansion of stablecoin usage, a rapid global 'dollarization' is expected. For South Korea, which is highly dependent on exports and imports, this emerged as a challenging macroeconomic variable. The spread of stablecoin usage in trade transactions will make it more difficult for the Bank of Korea and the government to monitor. This is expected to make it harder to implement monetary and macroeconomic policy.

This will also present both opportunities and threats to businesses operating in banking, credit card, and payment sectors. Byung-Kwan Lee, Deputy Director General at the Korea Institute of Finance, commented in his report "Implications of the U.S. Full-Scale Stablecoin Issuance Move" that "with broader stablecoin circulation, supply and demand for financial services on the blockchain may also expand."

Mi-Hyun Jo, Reporter mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)