Foreign Securities Dividends Double in H1 This Year... Coinbase ETF Takes Top Spot

Summary

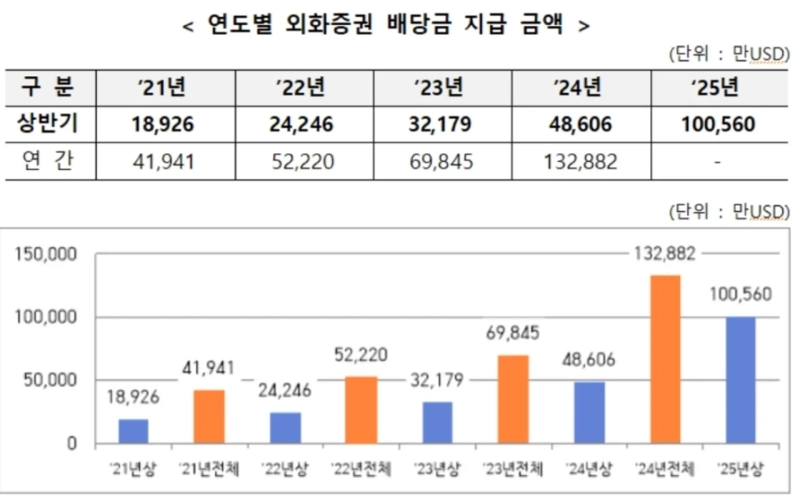

- Dividends on foreign securities paid to domestic retail investors in the first half of this year increased by 107% compared to the same period last year.

- US stocks accounted for 92.4% of the total dividends paid, and all of the top 10 dividend-paying securities were US ETF products.

- The top spot was taken by an ETF based on 'Coinbase' stock, a cryptocurrency exchange, with dividends reaching $124 million.

Korea Securities Depository (KSD) announced on the 21st that dividends paid to domestic retail investors for foreign securities in the first half of this year reached $1.01 billion, up 107% from the same period last year ($486 million).

By region, US stocks paid $929 million in dividends, accounting for 92.4% of the total. According to KSD, the share of US market dividends has continued to increase, from 76.3% in 2021 to 87.2% in 2023, and 89.3% last year.

The Japanese market paid $52 million in the first half of this year, making up 5.2%, ranking second after the US, while all other markets accounted for less than 1% each.

The top 10 securities by dividend payments were all US ETF products. First place went to an ETF based on stock in 'Coinbase,' a cryptocurrency exchange, with dividends reaching $124 million.

No US company stocks made the top 10 by dividend payments, and the well-known REIT (Realty Income Corporation) ranked 11th with $17 million.

KSD stated, "We will continue our efforts to quickly process foreign securities rights and protect the rights of domestic investors in foreign securities."

Reporter Chae-Young Kim chaechae@wowtv.co.kr

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)