Editor's PiCK

S&P500 and Nasdaq Hit Another All-Time High on Strong Corporate Earnings

Summary

- It was reported that the S&P 500 and Nasdaq Composite reached all-time highs due to strong earnings by U.S. companies.

- FactSet data revealed that over 85% of S&P 500 companies have reported results that exceeded expectations.

- This week’s earnings releases from Alphabet and Tesla are considered key variables determining the market’s further upward trend.

Optimism Spreads Amid Stable Bond Yields

Alphabet and Tesla Earnings Scheduled for This Week

Amid strong corporate earnings in the United States, the New York stock market once again opened the week with both the S&P 500 and Nasdaq Composite reaching record highs on the 21st (local time).

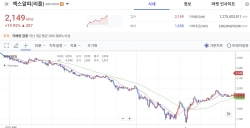

As of 10:10 a.m. Eastern Time, the S&P 500 rose 0.4%, surpassing 6,300 points. The Nasdaq Composite advanced 0.7%. The Dow Jones Industrial Average also edged up by 0.2%.

Reports suggesting President Trump’s imminent dismissal of Powell, followed by repeated denials by President Trump, previously led to long-term U.S. Treasury yields surging above 5% last week, but the Treasury market has since stabilized. The yield on the 10-year Treasury note fell 6 basis points (1bp=0.01%) to 4.36%, while the 2-year note dropped 2bps to 3.85%.

The Bloomberg Dollar Spot Index declined 0.3%. While the Japanese Prime Minister declared he would continue to lead the administration despite losing the election, the yen rose 0.8% against the dollar, reaching 147.63 yen.

Surprising earnings from major banks kicking off last week's reporting season helped spread optimism on Wall Street, even amid tariff risks. The S&P 500 gained 0.6% and the Nasdaq 1.5%—both setting fresh record highs last week. The Dow finished slightly lower.

According to FactSet data, over 85% of the 62 S&P 500 companies that have announced results so far have exceeded expectations. BofA stated that the second-quarter earnings of companies reported last week grew 5% year-over-year.

Should Alphabet and Tesla deliver better-than-expected earnings this week, the market's upward momentum could continue. The so-called Magnificent 7, the largest-cap U.S. companies, are expected to drive earnings growth this reporting season as well.

FactSet analyst John Butters projected 14% earnings growth for the Magnificent 7 companies in Q2, while the remaining 493 S&P 500 companies are estimated to see just 3.4% growth.

U.S. Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick of the Trump administration commented on trade negotiations ahead of country-specific tariffs taking effect on August 1, bringing trade talks into the market spotlight. Following Lutnick’s remark that, “While August 1 remains the deadline, we won’t prevent dialogue with countries beyond that date,” Bessent also emphasized that “the quality of the negotiations is more important than timing.”

With key U.S. trading partners, including the European Union (EU), reportedly raising the tempo of discussions, President Trump stated that several major trade deals are approaching announcement.

Kim Jeong-a, Guest Reporter kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)