Ronald Temple: "U.S. stock market optimism is excessive... If August tariffs hit, a drop of up to 15% is possible"

Summary

- Chief Market Strategist Ronald Temple warned against excessive optimism in the U.S. stock market, stating that if tariffs are imposed in August, stock indices could drop by up to 15%.

- Temple cited ongoing inflation, sustained high interest rates, and the near-zero likelihood of an interest rate cut by the Fed as negative factors for the market.

- He advised reducing the U.S. allocation in portfolios and diversifying into emerging markets, Japan, and Europe.

Ronald Temple, Chief Market Strategist at Lazard Asset Management

Corporate value declines inevitable due to inflation

Fed's interest rate cut possibility this year 'zero'

Reduce U.S. allocation and invest in emerging markets

"U.S. GDP growth rate, inflation, and corporate earnings—all indicators are unfavorable, yet stock prices are rising. This means investors are being overly optimistic."

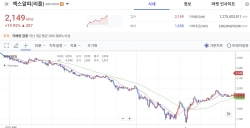

Ronald Temple, Chief Market Strategist at Lazard Asset Management (pictured), stated in an interview with The Korea Economic Daily on the 22nd, "The U.S. stock market has nearly reached an all-time high," emphasizing the need to be wary of the prevalent optimism in the market. He noted that the ongoing record highs in leading indices like the Nasdaq and S&P 500 are not 'normal.' As the head of macroeconomic strategy and market outlook at Lazard Asset Management, Temple is recognized as a geopolitical expert on Wall Street.

He cited the repeated reversals in tariff policy by the Donald Trump administration as a major factor. Temple explained, "After the announcement of reciprocal tariffs in April, U.S. stocks, bonds, and currency were simultaneously sold off, prompting the government to quickly defer the policy, which led to a market rebound. Optimism spread as investors began to believe the government would change its policy again if conditions worsened."

Temple warned that the market could move differently after the 'Trump tariff D-day' on the 1st of next month. He said, "U.S. stock indices could decline by 10~15%." This is due to concerns that tariffs may fuel inflation. Temple noted, "With high interest rates maintained because of inflation, stock multiples (corporate value ratios) are bound to fall. If the real wage growth rate for workers slows, consumption will decrease, and as a result, corporate earnings will also decline."

Another negative factor is the near-zero likelihood of an interest rate cut by the U.S. central bank (Fed) this year. He said, "The Fed cannot lower rates in a high inflation environment" and predicted, "rate cuts will not start until next year."

Given that market volatility is expected to increase after the tariff imposition, Temple advised investors to adjust their U.S. allocation in their portfolios. He recommended emerging markets, Japan, and Europe as alternatives. He stated, "Over the next 5~10 years, emerging markets will outperform other markets. Japan, where corporate governance is improving, and Europe, which is undergoing changes such as fiscal expansion to promote growth, are also positive."

South Korea was also identified as a promising investment destination. However, he assessed that the attractiveness of the Korean market would only increase if the issue of low Return on Capital (ROC) is resolved. ROC is an indicator that shows how much actual profit is generated relative to capital invested.

— Reporter Ji-Yoon Yang yang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)