Editor's PiCK

'Japan lowers tariffs with an investment bundle… The US likely to demand promises from Korea as well'

Summary

- It was reported that Japan struck a tariff reduction deal with the US through a $550 billion investment package.

- The US is likely to pressure South Korea in Korea–US trade talks by demanding a similar investment plan.

- South Korea's key strategy is to leverage its manufacturing cooperation package to minimize US demands and attain tariff reductions.

Scenario for Korea’s Tariff Negotiations

Japan First Proposed US Investment Plans

"90% of investment profits to be reinvested in the US"

Trump Increased Amounts During Talks

Becoming a 'Last-Minute Variable' Ahead of Korea Talks

Korea Puts Forward 'US Manufacturing Cooperation'

US Pressures Korea: "Submit Investment Plans, Too"

Expect Tug-of-War Over Investment Amount & Terms as 'Supporting Manufacturing Competitiveness' Becomes a Leverage

Japan wrapped up tariff and automobile item rates at 15%, while offering a $550 billion (about ₩760 trillion) investment 'gift bundle' to the United States, creating an emergency for the Korean negotiation team just two days ahead of the Korea-US 2+2 trade talks. This is because the US is likely to make similar demands to Korea. Leveraging Korea’s strength in 'manufacturing cooperation packages' to secure greater tariff reductions with minimal concessions, beyond Japan’s levels, has emerged as a new challenge.

◇Japan Lowers Tariffs with a ₩760 trillion Investment Package

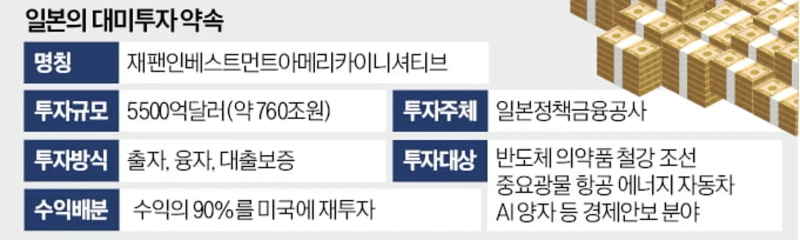

According to Korea–Japan trade authorities on the 23rd, Japan agreed to the US-Japan tariff talks on the 22nd (local time), promising an investment plan called the 'Japan Investment America Initiative.' The Japan Bank for International Cooperation, a policy finance institution, served as the investment entity, investing $550 billion in key economic security fields in the US—such as semiconductors, steel, shipbuilding, aviation, automotive, AI, and quantum—by way of equity injection, loans, and loan guarantees.

Donald Trump, the US President, posted on social media, "The $550 billion investment is made per my direction, and the US keeps 90% of the profit." It is reported that 90% of the returns from the investments will be reinvested in the US. The investment period was not disclosed.

Japan has been classified as a major US trading partner where tariff negotiations were not proceeding smoothly. Japan was strongly committed to abolishing or at least lowering the 25% item-specific tariffs on its core export—cars—but the US was negative about reducing them. After failing to reach an agreement in seven negotiation rounds, the US notified Japan on the 8th that it would raise Japan’s mutual tariffs from 24% to 25%. Squeezed by the negotiation deadline, Japan managed to secure a reduction in mutual tariffs (25%→15%) and car item tariffs (25%→12.5%) by coming to the table with the $550 billion investment bundle.

◇Korea Turns to the 'Manufacturing Cooperation' Card

With the US–Japan tariff deal, Korea faces greater pressure ahead of the Korea–US 2+2 trade talks on the 25th. It has become harder to rely on the US's desire for negotiation achievements. Above all, the US government is burdening Korea with demands for an investment plan similar to Japan's. Japan's plan exceeds Korea’s annual budget this year (₩677 trillion/$490.4 billion).

Because Korea's economy and US trade surplus are smaller than Japan’s, the US probably won’t demand all $550 billion. However, experts say the target will likely be significant enough for President Trump to tout achievements. Even if most of Korea's plan is filled with loan guarantees (under which, if a company fails to repay a loan, the government covers it), tens of trillions of won may still be needed.

Initially, Japan had proposed a $300 billion investment to the US. But through the negotiations, the amount rose to $400 billion, and in the final settlement it ballooned to $550 billion. In a photo of the negotiation room posted that day on social media by Virginia Foxx, Republican Representative (North Carolina), President Trump is shown holding a panel where the investment amount was revised on the spot from $400 billion to $550 billion. Considering Trump’s trademark ‘unpredictability’ in negotiations, analysts say that Korea could also face unexpected amounts in demands.

On the day the tariff agreement was concluded, President Trump also said, "Japan plans to start a joint venture for liquefied natural gas (LNG) investment in Alaska." Korea may well face similar demands.

Korea’s leverage against US pressure is its 'manufacturing cooperation package.' How much it can pare down US demands through cards that help revive US manufacturing competitiveness—in shipbuilding, steel, semiconductors—will be a new focal point in the Korea–US tariff negotiations.

Byoung-Hyo Jeong / Dae-Hoon Kim, Tokyo = Il-Kyu Kim, Correspondent hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.