Summary

- In Q2, GDP increased by 0.6%, driven by private consumption and semiconductor exports.

- There are projections that South Korea could achieve an annual growth rate of 1% depending on the outcome of South Korea–United States tariff negotiations.

- If a 25% reciprocal tariff is implemented starting from Q3, it is reported that the negative impact on exports could be fully reflected.

Q2 escapes negative growth with 0.6%, largest increase in 15 months

First time exceeding Bank of Korea's quarterly forecast

Private consumption turns to growth after being suppressed

Exports surge 4.2%... Semiconductors lead the way

Focus on the impact of 'second supplementary budget' on boosting domestic demand

Effects of tariffs to be fully felt from Q3

In the second quarter of this year, South Korea's gross domestic product (GDP) increased by 0.6%. As semiconductor exports and private consumption showed signs of recovery, the result exceeded the Bank of Korea's original forecast of 0.5%. There are projections that annual growth of over 1% could be possible this year if South Korea–United States mutual tariff negotiations are smoothly concluded.

Consumption and exports strong, investment sluggish

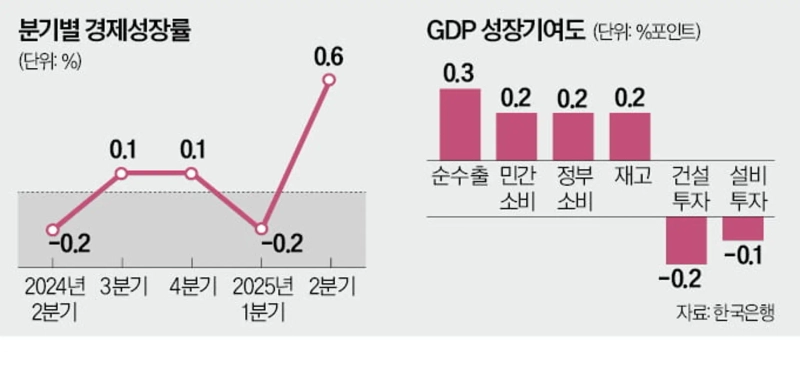

According to the Bank of Korea's '2025 Q2 Real GDP (preliminary)' announced on the 24th, real GDP grew by 0.6% compared to the previous quarter. After contracting by -0.2% in Q1, growth turned positive. This is the highest quarterly growth rate in 15 months since Q1 2023 (1.2%).

By expenditure category, both private and government consumption increased. Private consumption shifted to a 0.5% increase from a -0.1% decrease in the previous quarter. Dongwon Lee, Director of the Economic Statistics Department at the Bank of Korea, said, "Consumer sentiment improved as political uncertainty eased, showing a pattern in which consumption was better in May than April, and even better in June than May."

By item, sales of passenger vehicles rose in goods consumption, and in services, spending on performances and cultural sectors increased significantly. Government consumption climbed 1.2%, mainly due to expanded health insurance benefit payments, marking the largest increase in two and a half years since Q4 2022 (2.3%).

Exports also grew more than expected, rising 4.2% mainly driven by semiconductors and petrochemicals, rebounding from -0.6% in Q1. Imports rose 3.8%, mainly due to energy products. Mr. Lee commented, "Semiconductor exports exceeded expectations, and some items may have experienced pre-demand ahead of the mutual tariffs from the United States."

Investment remained sluggish. Construction investment fell by -1.5% in Q2, following -3.1% in the previous quarter, marking five consecutive quarters of decline. Facility investment fell further from -0.4% to -1.5%.

In terms of growth contribution, the private sector accounted for 0.5 percentage points. Private consumption and net exports contributed 0.2 and 0.3 percentage points, respectively. In contrast, private investment made a negative contribution of -0.2 percentage points. Inventory increases contributed 0.2 percentage points, and the government contributed 0.1 percentage points.

U.S.-Korea tariff negotiations determine this year’s growth rate

Both within and outside government, the possibility of achieving an 'annual growth rate of 1%' is gaining traction. Statistically, 0.8% growth in both Q3 and Q4 would meet the annual 1% target. This figure is higher than the Bank of Korea's Q3 and Q4 forecasts released in May (0.7% and 0.6%, respectively), but at that time, the impact of the second supplementary budget was not reflected. Mr. Lee explained, "The first supplementary budget focused on government spending and the second on boosting private consumption, so domestic demand could strengthen further in Q3."

At the end of next month, the Bank of Korea will release its revised economic outlook, and there is talk that the annual growth forecast could be raised from the current 0.8%. Overseas investment banks have also recently inched up their growth projections for South Korea, citing easing trade tensions between the United States and China, and the expansionary fiscal policy of the Jaemyung Lee administration.

A key variable is the ongoing tariff negotiations between South Korea and the United States. If the 25% mutual tariffs announced by the U.S. take effect as scheduled on the 1st of next month, exports could be significantly hit. Mr. Lee predicted, "Once the tariffs are finalized, export slowdown will begin. While the impact was minor in Q2, it could be fully reflected from Q3 onward." If South Korea's reciprocal tariffs on the United States drop to the Japanese level (15%), it is expected not to negatively affect the growth rate. This is because the Bank of Korea based its growth estimate on an average tariff level of 15%.

Jinkyu Kang, Reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.