Summary

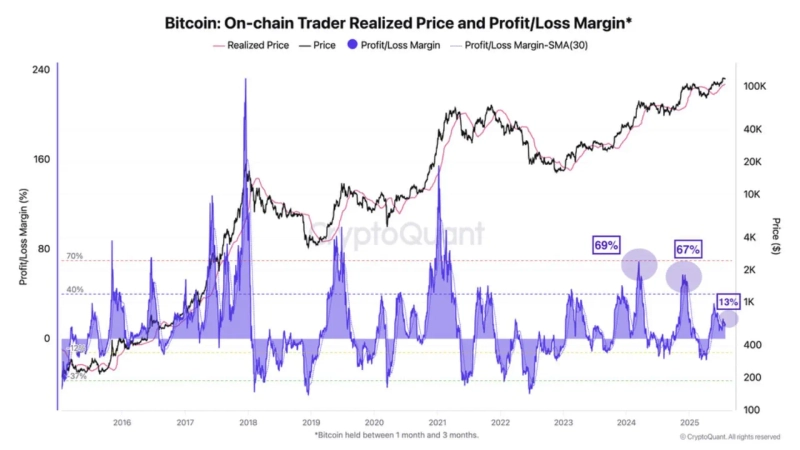

- It was reported that the average return of Bitcoin on-chain traders is 13%, which is low compared to previous cycles.

- Accordingly, it is expected that the possibility of short-term investors realizing profits through selling will be low.

- However, in the event of a panic sell, a price correction may occur, and such periods could present good opportunities in the market.

Despite Bitcoin (BTC), the leading digital asset (cryptocurrency), recording a rally this year, actual trader returns have remained at a sluggish level.

On the 28th (KST), a contributor for Dark Post CryptoQuant stated in a report, "Although Bitcoin has reached an all-time high, the average on-chain trader return is currently just 13%," adding, "The likelihood of these traders realizing profits by selling appears to be low."

On-chain traders refer to spot traders who execute transactions between wallets rather than on exchanges, and are typically short-term investors holding Bitcoin for 1–3 months.

The contributor noted, "In 2012 and 2021, the average returns for this group were 232% and 150%, respectively," and added, "During this cycle, the returns for these groups are relatively low."

However, he warned that a panic sell-off could occur due to price corrections. The contributor explained, "If these traders engage in panic selling, a sharp price adjustment must also be considered," but also pointed out, "Whenever these traders have capitulated, the market has always presented good opportunities."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)