"Bitcoin Long-Term Holders Show Signs of Taking Profits Near the $120,000 Resistance"

Summary

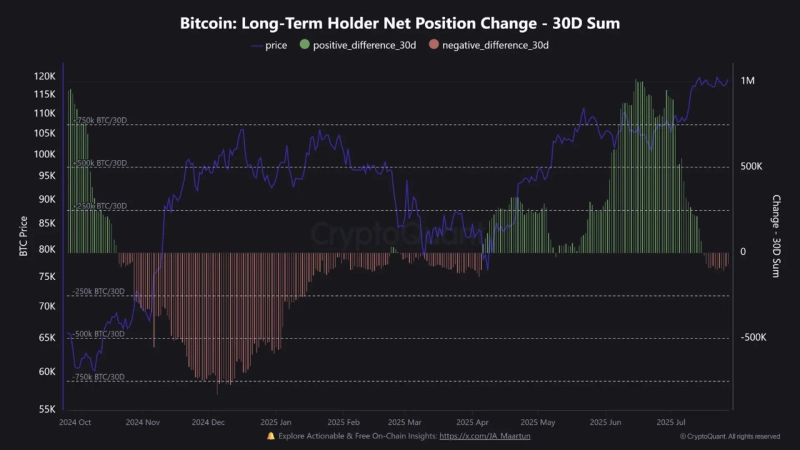

- It was reported that some long-term holders are reducing their positions near the $120,000 resistance line for Bitcoin (BTC).

- Long-term holders’ net positions have shifted to a sell-side bias around $120,000, and there are indications they are realizing profits.

- Evidence shows Galaxy Digital has sold about 80,000 BTC, but the overall scale of selling is still considered limited.

As Bitcoin (BTC) is being traded near the $120,000 resistance line, on-chain data has revealed that some long-term holders are reducing their positions.

On the 29th, Burak Kesmeççi, an analyst at the virtual asset (cryptocurrency) analytics platform CryptoQuant, stated in a Quicktake report, "Recently, the net position of long-term holders has shifted to a sell-side bias around $120,000," and added, "There are signs that investors who have experienced previous bull markets are realizing profits at this point."

However, the overall scale of selling is still considered to be limited. Kesmeççi commented, "There is evidence that Galaxy Digital has sold about 80,000 BTC, which is a scale entirely different from that of individual investors," and emphasized, "Further on-chain analysis is required to assess the medium- to long-term trend."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.