[Analysis] "Bitcoin speculative frenzy subsiding... possibility of hitting new all-time highs"

Summary

- It was noted that speculative pressure in the Bitcoin futures market is declining.

- ShayanMarkets analyzed that investors are reducing leverage and de-risking.

- The recent price increases are being supported by real demand rather than excessive leverage, indicating that if the trend of low speculative intensity continues, there is a possibility of hitting new all-time highs.

An analysis has emerged showing that speculative pressure in the Bitcoin (BTC) futures market is on the decline.

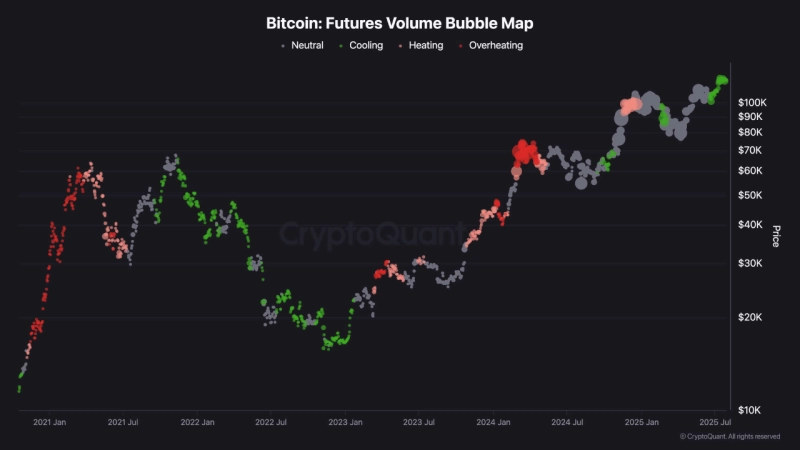

ShayanMarkets, a contributor at CryptoQuant, stated on the 30th via CryptoQuant, "Although Bitcoin is trading near the $123,000 mark, the 'trading volume bubble map' is at a neutral or cooling-off stage," adding, "This suggests that speculative pressure in the futures market is decreasing." ShayanMarkets explained, "The fact that (Bitcoin) prices remain high while futures trading volume decreases means that investors are deleveraging and engaging in 'de-risking.'"

ShayanMarkets emphasized that Bitcoin's upward trend could resume in earnest. ShayanMarkets analyzed, "On-chain indicators show that after a (speculative) frenzy, this kind of genuine demand is generally interpreted as a healthy sign," adding, "(Recently) the price increase is being sustained by real demand rather than excessive leverage." He further commented, "If the trend of low speculative intensity continues, Bitcoin could regain upward momentum and move toward new all-time highs."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)